After the release of ChatGPT, a friend and I came up with about a dozen products that could be created with it. However, most of those ideas became irrelevant over the next year because of GPT-4 and other major tech launches.

So I imagined a scenario where I had spent a year working on a project, only for its value to disappear in a single day. From these reflections, I wrote this essay, where I try to answer the following question:

Which AI products are worth building and which aren’t if you’re a product manager?

While working on this piece, I listened to and studied a large amount of content from leading investors, entrepreneurs, and researchers in the AI field (links included at the end).

The following are my thoughts and conclusions. I fully understand that these are based on assumptions that may turn out to be incorrect. But for the sake of simplicity, I state them assertively, as if they are facts.

Which AI products will be discussed

Let’s start by assuming there are two types of AI products: the infrastructure layer and the application layer. The difference between them is well explained below.

| Infrastructure layer AI products Fundamental technologies for building AI solutions | Application layer AI products AI-based end solutions for specific tasks |

|---|---|

| — Cloud AI platforms (Google Cloud AI, AWS AI/ML, Microsoft Azure AI) — ML frameworks (TensorFlow, PyTorch, Apache MXNet) — Data management and processing (Apache Hadoop, Apache Spark, Databricks) — GenAI platforms, libraries, and frameworks (OpenAI GPT-3 / GPT-4 API, IBM Watson Studio) | — AI assistants and chatbots (Google Assistant, Amazon Alexa, IBM Watson Assistant) — Recommender systems (Netflix, Spotify, Amazon) — Computer vision (Google Photos, Tesla Autopilot, Face++) — NLP (Grammarly, ChatGPT, Duolingo) — Predictive analytics (Salesforce Einstein, Tableau, IBM Cognos Analytics) — Content generation: text, audio, video, code, etc. (ChatGPT, Jukebox, DALL-E, GitHub Copilot) |

This article will focus on applied AI products, or what is known as the Application Level.

— I will not discuss infrastructure layer products. Due to their specific nature, they are not well-suited for people with a background in product management.

— I also excluded products where adding AI does not create value. There is a lot of this on the market, as is often the case during any hype cycle.

I’m interested in the segment of AI products that solve a clear problem and create value for the end customer. Let’s try to answer the question: which of these are likely to disappear in a few years, and which will carve out their niches and generate long-term value?

Success criteria for AI products

I will divide potential AI product ideas into two categories:

- Products that make no sense to create.

- Products that make sense to create.

In the “make no sense” category are:

- Products that experience rapid growth after launch but cannot become profitable in the long run due to intense competition, negative unit economics, or other reasons (e.g., Stability AI).

- Products that achieve short-term success (rapid growth and profit) but fail to maintain their position in the long run due to an unsustainable model, short-lived demand, or other factors (e.g., Lensa).

- Products built to be sold to a “strategic buyer” (such as a big tech company), which have unique technology or a team but lack a real business around them (e.g., Character.ai).

In the “make sense” category, I will include:

- Products that can grow in a controlled manner and generate profit over a long period.

One more important point before we dive into the categories:

Products in the “make no sense” category can lead to great outcomes. Some teams and companies are interested in creating viral products that achieve flashy but short-term success, or in working on technologies or platforms to sell to major players. However, I am particularly interested in discussing the creation of products that can generate long-term profits based on the value they create.

AI products I wouldn’t create

We agreed to discuss AI products that can create value. However, even among those, there are some that I believe don’t make much sense for someone with a product background.

The key factor for analyzing ideas here is the long-term defensibility of the value the product creates. Who do we need to defend it from?

- Tech giants developing foundational AI models and mass-market products

- Companies that currently dominate certain markets

- Competition from other teams and companies that spot similar opportunities and launch their own projects

By analyzing product ideas through this lens, I would reject the following ideas:

- Foundation models and mass-market AI B2C products

- Wrappers that simply add an application layer on top of GPT or similar models

- New products in niches where existing players are already implementing AI

- Products designed for AI developers

We’ll discuss each of these categories in more detail, so if any of them seem unclear or not obvious, just keep reading.

Foundation models and mass-market B2C products on top of them

Looking at how the internet evolved will help us understand what’s happening now with this new technological shift.

The first wave of products to emerge were those sold as software to solve various tasks. The most competitive market segments were those where a product aimed to solve a problem for tens or hundreds of millions of users.

Here are examples of such products:

- Operating systems. Microsoft Windows, Linux.

- Web browsers. Netscape Navigator, Internet Explorer, Google Chrome, Mozilla Firefox.

- Search engines. Yahoo! Search, Google Search, Yandex Search.

- Image and video editing software. Adobe Creative Cloud.

The fierce competition for these markets was more than justified.

The winners enjoyed monopolistic or duopolistic positions, zero marginal costs for selling additional copies of their product, extremely high margins, and the prospect of further growth through the constant addition of new internet users.

Over time, most software niches were filled. As a result, new companies and investors gradually shifted their attention to products where instead of software, a service was sold to the customer. Software became just one part of the value chain.

Examples of such products:

- Ride-hailing (Uber, Lyft).

- Food delivery from restaurants (Doordash, Uber Eats, Deliveroo).

- Grocery delivery (Amazon Fresh).

- Neobanks (Revolut, Monzo, N26).

These businesses have lower margins, and scaling them is harder and requires more resources. This is why Google, Microsoft, Facebook, and other tech giants didn’t compete in these segments. This allowed other entrepreneurs to build multi-billion-dollar companies in these niches.

The generative AI wave is unfolding in a similar way. At the moment, the fight is over large, “software-based” market segments.

Examples

The first successful AI products of the current wave have taken the form of software/API-based products:

- Foundation models: OpenAI, Anthropic, Midjourney, Runway.

- Mass-market B2C products derived from them:

- General chatbots: ChatGPT, Claude, Gemini.

- Smart search: Perplexity.

- Various Copilots: GitHub Copilot, Amazon CodeWhisperer, Salesforce Einstein Copilot.

- LLM integrations with operating systems: Apple’s AI features and Microsoft Copilot.

What’s the problem with this segment?

Any large market segment where one product can meet the needs of tens or hundreds of millions of users (like the mentioned general assistants, image-generation systems, various Copilots, etc.) will be a top priority for all big tech companies.

Tech giants (Google, Meta, Amazon, Microsoft, Salesforce, Canva, and others) and well-funded startups with strong teams have rushed into this space after seeing early signals of success.

This dynamic has already led to a state where smaller teams have almost no chance of success. It’s highly likely that any valuable idea you come up with will be built by tech giants before you can release even the first version of your product.

Big companies have all the advantages: resources (both computational and financial), data, talent, the ability to invest in research and experiments, and most importantly — distribution.

Even if you find the right product form, big tech companies will have several years to replicate your solution and still win the market. A clear example of this is the Slack vs. Microsoft Teams rivalry.

Illustrating the problem

A great example is Stability AI.

The company raised over $150 million, created the popular Stable Diffusion text-to-image model, achieved product/market fit, and attracted a large user base due to its surge in popularity.

Despite all this, within two years, due to fierce competition from OpenAI, Midjourney, and other players, the company faced financial difficulties, the departure of key employees, and a top management shakeup orchestrated by investors. At one point, there were reports that investors were seeking a potential buyer.

Exceptions are always possible

If you (or a key partner) are an engineer or scientist at the level of leading specialists from OpenAI or DeepMind and have specific expertise in a narrow, high-demand domain, this might give you enough of a lead to raise funding and outpace others in this niche market. For example, Anthropic AI, which is now one of the main rivals to OpenAI, was founded by former OpenAI scientists who were not satisfied with the direction that the company was taking. Anthropic has managed to raise billions of dollars in funding from the likes of Amazon and Google.

Another potentially winning option is if you have unique proprietary data in a niche field that would be costly and difficult to collect from scratch. For instance, a dataset on specific tasks in specialized manufacturing or diagnosing rare diseases. Such a dataset can offer defensibility from competition and justify investment in more foundation models. However, you should note that in this case, your market will be significantly limited in scale.

Wrappers

Another category of products that is highly likely to become obsolete with each update from OpenAI and other players is wrappers built on top of foundation models.

These services are built on top of foundation models (GPT-x, Llama, Gemini, etc.), and their added value comes from solving various problems of the current versions of these models.

To solve these problems, they often use the following methods:

- Prompt engineering or model fine-tuning

- Integrating with external services and providers

- Adding a user-friendly UX/UI for a specific task

Examples

There are many wrappers. However, with each new version of a foundation model, a significant portion of them is at risk, as they stop creating added value.

Here are a few that have managed to create relatively sustainable value:

- Jasper, Copy.ai: Writing services (emails, statements, contracts, posts, etc.).

- СhatPRD: A service for creating Product Requirement Documents (PRD) for product managers.

- Spellwise: an AI keyboard for iOS.

- Tools for summarizing texts and videos, generating meeting or call summaries, generating ideas, logos, and so on.

What’s the problem with this segment?

Typically, the added value of wrappers is built on the local inefficiencies of a foundation model. As a result, this value is essentially a temporary patch on a short-term problem—it is highly limited.

Given the rapid development of foundation models, such problems are often resolved in the next version. This wipes out the value of many wrappers with each new model release.

If the value created by the wrapper remains resilient against improvements in the foundation model and the business grows quickly, you can expect competition from other startups as well as large companies and operating systems with powerful distribution channels (which brings us back to the points from the previous section on B2C services).

As an example, here are some comments from OpenAI CEO Sam Altman:

“I think fundamentally there are two strategies to build on AI right now. There’s one strategy which is assume the model is not going to get better and build all of these little things on top of it. Then there’s another strategy, which is to build assuming that OpenAI is going to stay on the same trajectory and the models are going to to keep getting better at the same pace. It would seem to me that 95% of the world should be betting on the latter category.

However, many startups have been built on the former category, which has resulted in the ‘OpenAI killed my startup’ meme as OpenAI makes the model and its tooling better.”

An example

Consider Jasper, a company that provides text-generation services based on generative models.

Initially, Jasper was doing very well.

- The company publicly launched its product in January 2021, based on GPT-3.

- In 2021, the company earned $45 million (access to GPT-3 was still limited and granted selectively).

- In 2022, revenue nearly doubled to $80 million (access to the GPT-3 and 3.5 APIs remained restricted until November).

- At the end of 2022, Jasper raised $125 million at a $1.5 billion valuation. The funds were intended for scaling. The company forecasted $250 million in revenue for 2024.

However, when OpenAI opened access to GPT models, it activated market forces that began eroding Jasper’s added value, impacting their growth model. Things became more difficult:

- In late 2022, OpenAI launched its own competing B2C product—ChatGPT.

- ChatGPT gained enormous popularity, attracting hundreds of millions of users within months. At the same time, other services—such as Google Docs and Notion—added AI features for text.

- Additionally, with open access to model APIs, many similar text-writing services emerged.

- As a result, Jasper’s growth slowed significantly. The company lowered its growth forecast for 2023 by 30%, reduced staff, changed CEO, and even lowered its internal company valuation.

Did Jasper manage to build a large business? Yes.

Will they hit their $250 million revenue target in 2024? Probably not.

Will they generate long-term profit? Given the rapid improvement of ChatGPT and other free alternatives, most likely not.

Exceptions are always possible

The problem with wrappers arises when the added value is reduced to the wrapper itself. In this case, the business has no defensibility against model updates and direct competitors.

However, specific scenarios can change this. Imagine the “wrapper” on top of a foundation model being just one piece of the value chain in a broader business.

For example, a business might allow data extraction from documents (where the “wrapper” works) but does so locally within the company’s network (due to privacy and data protection requirements), integrated with many specific data sources, compliant with regulatory demands, and delivered to end clients through a complex sales process aimed at large organizations.

There are such exceptions, and we’ll discuss them when we talk about products that do make sense to build.

New products in niches where existing players are already implementing AI

In a recent interview, the founder of Monzo, the UK’s largest neobank, shared that maintaining high-quality customer support costs the company around £12–13 per customer per year.

Monzo currently has about 10 million customers, so the rough estimate for ensuring quality support is around £120–130 million annually.

The question: will the new wave of AI technologies help solve the customer support challenge more efficiently and reduce the costs for Monzo and other companies? Yes.

Does this mean there’s an opportunity to create a new AI-first company in the customer support market? Most likely, no.

It is highly probable that the new value will be created by existing players and divided among them.

What’s the problem with this segment?

Companies leading the market for customer support tools benefit from adding new AI functionality to their products. Both their clients and investors expect it. More importantly, these companies have the expertise and resources to implement such projects.

Therefore, it will be very difficult for new AI-first companies in this segment to convince potential customers to switch to their solutions. Existing providers are already deeply embedded in their processes and will quickly adopt important innovations.

This reasoning applies to many industries and niches where AI can be integrated into existing products to make them better. Market leaders will eagerly integrate new capabilities, talk about it on investor calls, and showcase them in client presentations.

And they have significant advantages over potential new products: a user base, ready-made basic functionality, integrations into client processes, and an established growth and sales model.

Examples

Let’s look at Intercom, one of the leaders in the customer support solutions market.

- At the beginning of 2023, they started experimenting with the integration of GPT models. Just a few months later, they released their assistant, designed to help answer 50% of customer inquiries.

- In April of the same year, they launched Fin AI Copilot, an AI assistant for support agents that provides instant responses based on the company’s knowledge base and previous user interactions.

If you review the updates Intercom has released over the past year (check the blog post titles on product changes), you’ll see that AI has become a central element of their product strategy.

Another example is Chatfuel, a service for building chatbots for Facebook Messenger and WhatsApp.

- The company quickly recognized the potential of the new wave of AI technologies and began experimenting with custom solutions for specific clients, later integrating these functional elements into their core product.

- Today, AI-driven products are one of the main growth drivers for Chatfuel (you can see this by reviewing the product descriptions on their homepage).

Exceptions are always possible

There are market segments where companies can benefit from AI integration but lack the expertise and in-house talent to implement it. This opens up opportunities for startups. We’ll discuss this further. In some industries and use cases, adding AI may pose risks for large companies due to potential legal issues or PR scandals.

For example, Google was the first to develop a text-to-image model, Imagen, a precursor to Midjourney. However, Google decided not to launch a product based on this model due to potential risks, including ethical, legal, and others. This created an opportunity for Midjourney and OpenAI (DALL-E).

Interestingly, in recent years, OpenAI has grown so large that they now hesitate to release new breakthrough products for the same reasons. In the video generation segment, this has created opportunities for startups like Runway and Luma. These companies are opening their products to the public while OpenAI hesitates to release its own video generation model, Sora.

Products for AI developers

During a gold rush, it’s wiser to sell picks and shovels than to mine for gold.

The best illustration of this principle is Nvidia, which created the most universal and in-demand “shovel” in the world of AI development: their chips remain essential for training and serving models.

The approach Nvidia used applies to other companies creating products for AI developers.

Examples

- ElevenLabs, Play AI, Vapi — services for generating audio from text.

- Hugging Face — a platform providing access to a wide range of pre-trained models for NLP (Natural Language Processing), audio processing, and computer vision.

- Evidently.ai — a solution for monitoring data and models (including large language models).

What’s the problem with this segment?

Products for developers are a very promising and interesting area, especially under the assumption that AI will indeed become a crucial part of the world, create immense value, and significantly boost productivity in the long term.

However, the challenge is that such products are far better suited for engineer-founders. A technical founder will have a much deeper understanding of the problems faced by potential customers and have the necessary expertise to identify opportunities for creating value.

In contrast, people with a background in product management will need to focus on AI applications that match their strengths and experience. This will be my focus in this article.

A quick recap of products not worth creating

To summarize, here are the AI products that, in my opinion, are not worth creating for people with a product background:

- Foundational AI tech products, as well as mass-market AI B2C products derived from them

- Wrappers

- New products in niches where current players are already implementing AI

- Products for AI developers

These are examples of products that may create value, but it is difficult or impossible to defend that value from tech giants, market leaders, or simply competitors.

AI products worth creating

The products worth creating are those that can grow in a controlled manner and generate profit over a long period.

To identify such products, it’s important to pinpoint niches where AI creates significant value that can be defended from:

- Large tech companies: The chosen niche must be unappealing to them for some reason, and their mass-market B2C products should perform worse than your product in the specific problems it solves

- Future improvements in foundation models: Ideally, your product should improve as the models improve

- Direct competition: Classic defense mechanisms should kick in through network effects, branding, defensible distribution channels, economies of scale, access to limited resources, etc.

Based on these principles, the following categories are worth exploring:

- Products for automating manual processes in large companies

- Vertically integrated solutions

- Service industries that can be productized with AI

- Fundamentally new AI-first products

Let’s explore each in more detail.

Products for automating processes in large companies

In any large company, you’ll find numerous manual and inefficient processes. This is especially true outside the tech sector.

Generative AI technologies enable the automation of many processes that previously relied on manual labor. According to a McKinsey study, generative AI combined with other automation technologies could automate up to 60–70% of work processes in nearly all professions by 2030.

It is important to remember that a few years ago, cutting-edge NLP technologies were represented by Siri and Alexa, not GPT-4 and Gemini. New advances open a lot of opportunities.

The inefficiencies in processes within large companies are usually due to either their inertia or the lack of appropriate automation technologies. Both of these factors work in your favor here:

- If the company lacks the expertise to apply new technologies on its own, this significantly increases the value of your product and expertise.

- The inertia of a large organization creates a barrier to competition. To penetrate such companies with an AI automation product, it’s not enough to develop the technology and the product itself. You’ll also need to build an effective distribution, sales, and implementation process.

The need to establish sales and implementation teams, combined with the relatively small size of individual “manual work” segments that can be automated, makes these niches unappealing to large companies and unreachable for mass foundational products (you can read my LinkedIn post about the shut down of Workplace).

For a startup, the market size for these “manual work” segments is more than sufficient. Especially considering the potential for expansion into adjacent segments in the future.

Examples of products

A great example is Permitflow, a product that helps automate the process of obtaining various permits and licenses for construction companies.

Currently, this task is mostly done manually. People have to navigate complex requirements either by themselves or with the help of consultants, decipher jargon-heavy documents, and answer numerous questions.

Permitflow helps digitize and partially automate this process with generative AI.

Building such a product requires deep knowledge of regulations in different cities, along with adapting to the nuances of obtaining different types of permits. Moreover, the target segment—construction companies—are not tech-savvy, meaning that sales, implementation, and training processes need to be added. All of this creates strong business defensibility.

Another example. I recently came across an early-stage project aimed at automating the manual work done by compliance officers in financial organizations.

Currently, 90% of such tasks are performed manually. These tasks often involve analyzing large volumes of documents, searching for information about individuals or companies in public sources, and then analyzing and structuring that information.

Many of these tasks can be significantly simplified or fully automated using generative AI.

Even though the product’s value is partially derived from wrappers around foundation models (which we previously categorized as not worth doing), this product achieves sufficient defensibility due to several factors:

- First, the “wrapper” becomes just a small part of the entire product.

- Second, the product targets a highly regulated segment with numerous constraints related to regulatory requirements, security, and more.

- Third, distributing such products requires a specialized sales, implementation, and training process.

How to approach this segment

When working on these types of products, it makes sense to start with a service or consulting model (several consulting firms are likely moving in this direction already).

- You’ll need to find clients willing to pay for custom solutions tailored to their specific needs.

- As you gather more clients, you should look for common denominators across projects that can be turned into a product.

This approach allows you to study client problems, learn how to sell, and most importantly, find a reproducible product form.

Vertically integrated solutions

After Google won the search market, many believed it was impossible to compete with them—at least not head-on.

And indeed, direct competition has proven futile. Just look at the unsuccessful attempts of Bing in the U.S.

However, verticalization proved to be a successful strategy.

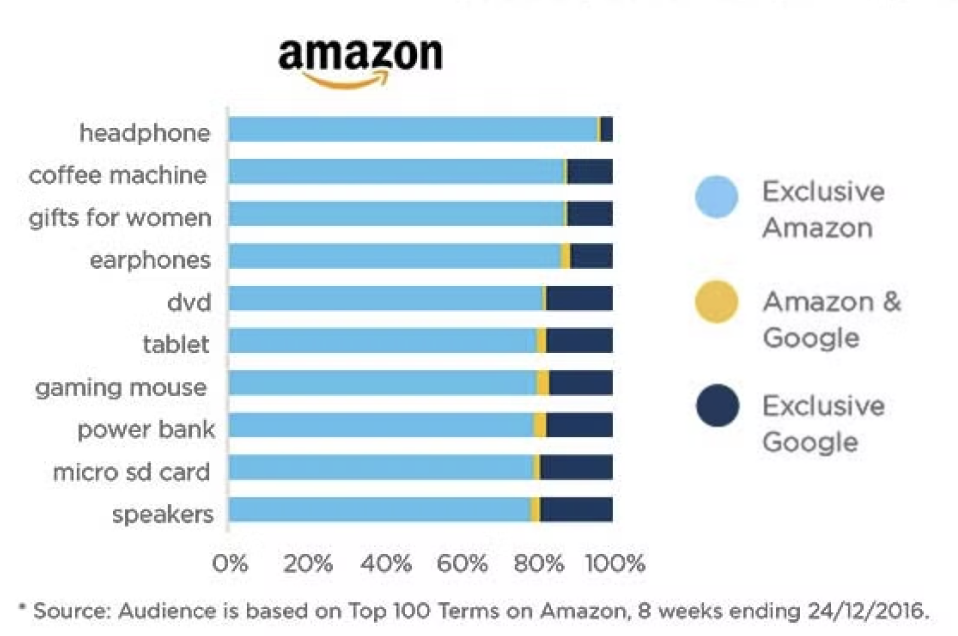

Many vertical products thrived and managed to capture part of Google’s market share. For instance, Amazon has surpassed Google in product search.

Why?

It’s more efficient to search for products directly on Amazon than on Google. Amazon is a vertical solution tailored specifically for product search and purchasing.

The same dynamic can be seen in other verticals:

- In flight searches, Kayak, Skyscanner, and Expedia hold strong positions.

- For real estate searches, Zoopla, Rightmove, Opendoor, and Zillow are leaders.

- In hotel searches, Booking and Airbnb dominate.

- In job and talent searches, LinkedIn and Indeed lead the way.

We’ve discussed that when a new tech wave begins, mass horizontal products often emerge. However, these products have a weakness—they can’t specialize deeply for every specific task. This opens opportunities for startups.

Verticalization is one of the classic strategies for startups competing with mass horizontal products. The essence of the strategy is to focus on a narrow segment and create a solution that will be significantly more effective than existing ones.

A prime example of this strategy in action is the verticalization of Craigslist, one of the oldest classified ad platforms. Out of nearly every category in Craigslist, multibillion-dollar services have emerged, each tailored to solve a specific task.

How does this relate to the current AI market?

We are at a point where the market is dominated by the first mass horizontal solutions like ChatGPT, Perplexity, Gemini, and others.

There’s no point in competing with them directly.

However, there are opportunities to create significant additional value through verticalization and to build strong defensibility mechanisms.

Here are a few areas where verticalization could offer valuable opportunities:

- Highly regulated industries

- Sectors that limit the use of mass generative AI products

- Companies with specific data security requirements (finance, health, legal)

- Tasks requiring special integrations and data

Examples

Earlier, we discussed Jasper, a company offering a text-writing service whose growth prospects worsened with the arrival of ChatGPT and many competitors.

Let’s now talk about Jenni, a similar tool that helps with writing academic papers. This specific focus allows Jenni to differentiate itself and build strong defensive mechanisms.

One of the key defensibility mechanisms against big tech companies is banking on the fact that using generative AI in educational contexts is a highly controversial topic.

Many universities and schools oppose it and block ChatGPT and similar tools. For OpenAI or Google, academic writing is a niche market, and they aren’t willing to allocate separate resources to it. Meanwhile, Jenni is steadily building relationships within the academic market, earning the trust of universities, researchers, and students.

Verticalization also enables Jenni to create a product advantage by tailoring itself to the specific demands of the academic writing process. Writing academic papers requires:

- Citing sources in specific formats (APA, MLA, IEEE, Chicago, Harvard)

- Specialized formatting for formulas (handling LaTeX, DocX, PDF)

- Integration with reference management software and bib files

- Writing text while avoiding plagiarism

Additionally, focusing on academic writing—which often requires review and feedback—introduces network effects and virality among students and university staff.

Thus, Jenni’s verticalization and specialization in the academic writing use case allows it to both create significant product value and build strong defenses against competition.

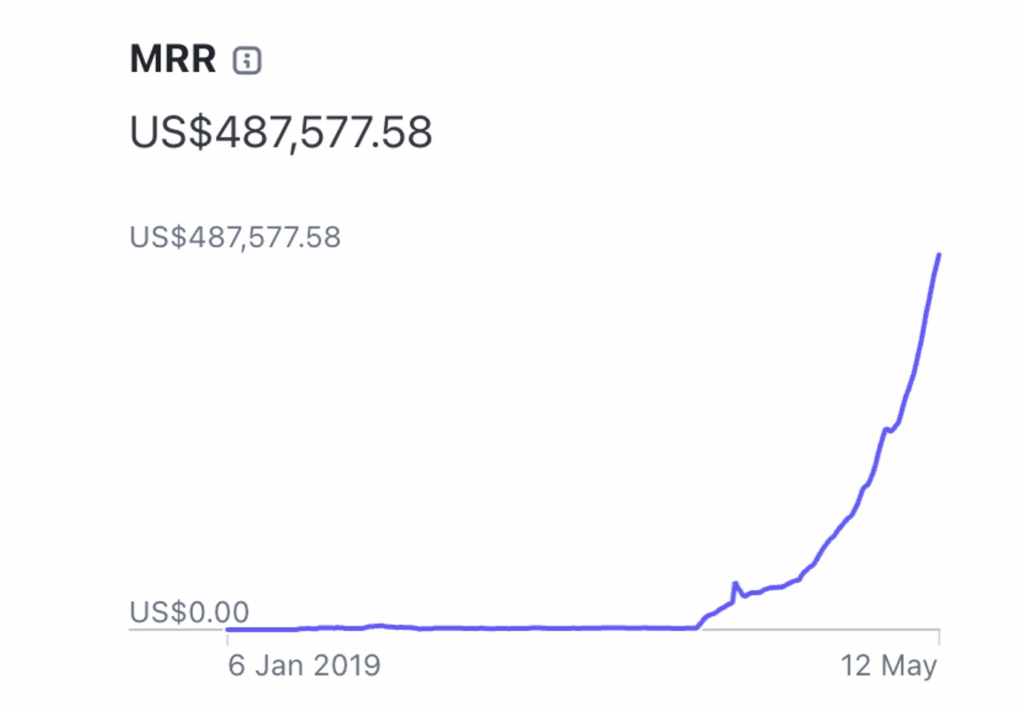

As a result, Jenni is experiencing rapid growth. And what is even more important, growth that is profitable.

Another successful example of a company built around a vertical product is Synthesia.

The company initially started with AI-avatar technology capable of presenting information. However, they eventually found valuable use cases within corporate education and completely restructured their commercial products to cater to this vertical.

Here’s how it works:

Most large companies have internal departments dedicated to employee training. Traditionally, these departments relied on classic tools: recording videos with real people, editing, processing, adding graphics, and uploading content to learning management systems (LMS).

This approach is very expensive. It becomes even more costly to update these materials in the future. Something you have to do all the time with the educational content.

Synthesia reduces the cost of creating educational videos significantly—and even more so, the cost of updating them. Instead of reshooting videos, all that’s needed is to modify the text of the script and regenerate the video.

Today, more than half of Fortune 500 companies use Synthesia’s tools. This means Synthesia has:

- Built effective sales, implementation, and training processes for large clients

- Acquired the necessary certifications and passed the required checks to integrate into the internal IT systems of large organizations.

Furthermore, Synthesia continues to improve the quality of its video generation and tailor its solution to client needs by adding features for specific use cases.

All of this makes Synthesia’s business highly defensible:

- Large tech companies are unlikely to specialize their solutions for a specific use case or build sales teams around it, even for major clients.

- Foundational video and avatar generation models fall far short of Synthesia’s capabilities in the corporate training use case.

- Direct competitors will also struggle—Synthesia already serves the most desirable clients, and it will be difficult to convince them to switch to a similar solution.

Service industries that can be productized with AI

💡 This is my favorite category. If you’re working on something like this, I’d love to connect and chat. Feel free to reach out at oleg@gopractice.io.

When new technologies emerge, most companies focus on giving customers new possibilities and experiences. Most teams try to do things that were previously impossible.

Far fewer explore opportunities to make familiar tasks cheaper and more efficient. But this is often where hidden value creation lies through new technologies.

In the context of the expanding AI wave, the strategy of “doing familiar tasks cheaper and more efficiently” becomes especially compelling when applied to agencies and service industries that meet the following criteria:

- High fragmentation: Many small and medium-sized businesses with no clear market leader.

- Low differentiation: The offerings and capabilities of companies are quite similar to each other.

- Predictable, easily replicable non-physical labor: Companies require many employees who don’t need unique skills, performing repetitive actions like cold calling potential clients or collecting standard data.

These segments are particularly interesting because generative AI can transform agencies or service businesses into productized ones. Maybe not entirely, but significantly enough to change cost structures and improve business margins.

Why is the business model defensible?

Large tech players won’t enter these market segments—it’s too small and complex for them. Direct competition from existing companies is the norm in such markets (as evidenced by low differentiation and high fragmentation).

Moreover, the likelihood that other players can do what you will is low—most of them lack the skills to implement AI and other technologies effectively.

Examples

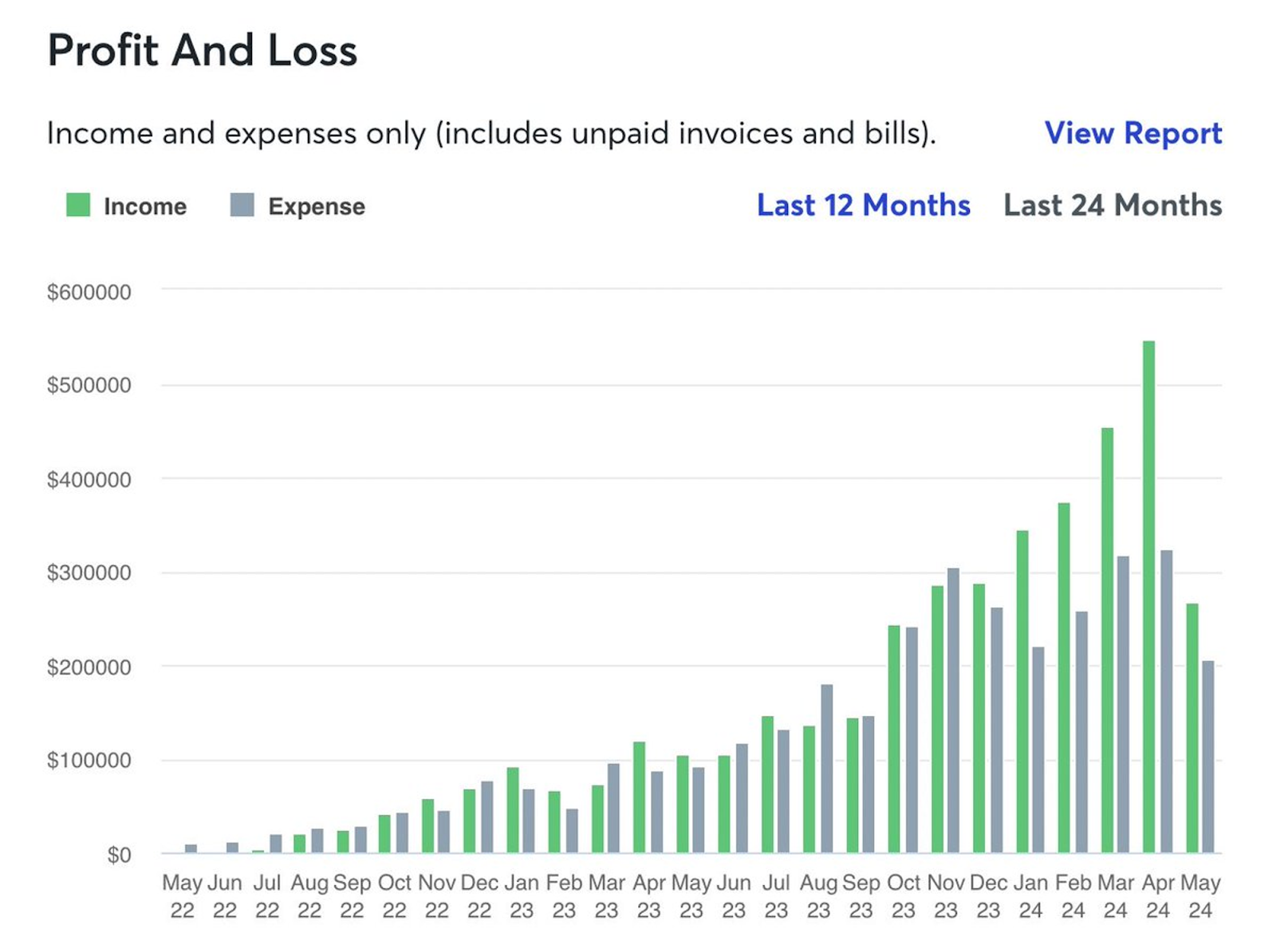

Take the startup Dwelly, which operates in the UK rental property market.

The team reworks existing agency processes using AI and other technologies to significantly improve the client experience and boost efficiency.

The rental market is highly fragmented (with countless agencies, and the market leader controlling less than 10%). Most of these are small or medium-sized companies with lots of manual work and minimal automation (usually just a basic CRM or, more often, lots of Excel and Word). Despite this, most companies are profitable.

Within these agencies, many processes can be automated using AI. For example:

- Manually uploading new rental listings to websites and marketplaces

- Manually gathering leads from websites or marketplaces, calling them to fill out customer details, and scheduling viewings

- Answering standard questions about properties

- Handling tenant support, issue resolution, certifications, etc.

Automating these processes for a small agency reduces the need for staff, improves the customer experience, and significantly boosts margins.

Another example from a similarly structured market:

Consider accounting services for small and medium-sized businesses. Most companies in this segment use basic automation (accounting software) and mainly rely on manual labor on top of that software.

By narrowing the target to a typical business, it’s likely that a combination of existing software and new generative AI capabilities could take over a significant portion of the manual work. Human intervention would only be needed to review the results.

This would result in dramatically improved efficiency (allowing one person to serve far more clients) and better margins.

There are many other markets where companies rely heavily on manual labor to repeatedly perform predictable tasks, like cold calling or data collection. In these sectors, generative AI could prove especially effective.

How to approach the segment

The key first step is to prove with a real business that your hypothesis about process automation works.

From there, you can take various strategies to deliver this value to end clients and turn it into profit or company valuation.

Options include:

- Partnerships: Collaborate with established players to embed your automation into their services.

- Aggressive growth through undercutting: Offer services at lower prices than competitors by leveraging automation to reduce costs.

- Private Equity-style approach: Acquire companies and optimize their processes using your automation technologies.

One distinctive aspect of this category of products is that the outward-facing business may not change. You’ll still be offering the same services as before.

However, internally, instead of a costly, complex manual system, you’ll have a highly reproducible automated process. In essence, this is about the industrialization of service industries.

Fundamentally new AI-first products

As is often the case with the emergence of new technology, the first implementations take the form of features added to existing products.

When the internet began spreading, many companies simply created corporate websites. Only later did native online products emerge that weren’t possible before, such as Google, Facebook, Pinterest, and various SaaS businesses.

Similarly, the first mobile apps were extensions of web services adapted to the small screens of smartphones. For example, Flickr launched an iPhone app, as did many other photo apps that are now long forgotten.

It wasn’t until later that Instagram found the right combination of camera, filters, and social networking to create a truly mobile-native experience. Even later, Snap and TikTok combined camera, touchscreens, video, and recommendation algorithms to create experiences that were even more suited to mobile platforms.

In the current AI wave, we are at a stage where large products are adding AI features that rarely change the user experience in a fundamental way.

Consider how over the past year, Microsoft and Google have both introduced “generative” AI features across their product lines.

At the same time, interesting new products are starting to emerge that reimagine how user problems can be solved from first principles. I believe that over time, more such products will appear.

While it’s impossible to predict which of these experiments will succeed, I’ll share a few examples of companies that have caught my attention and could be considered native AI products.

Limitless AI — a device that remembers everything

Dan Siroker, former CEO and co-founder of Optimizely, launched a new AI company called Limitless AI.

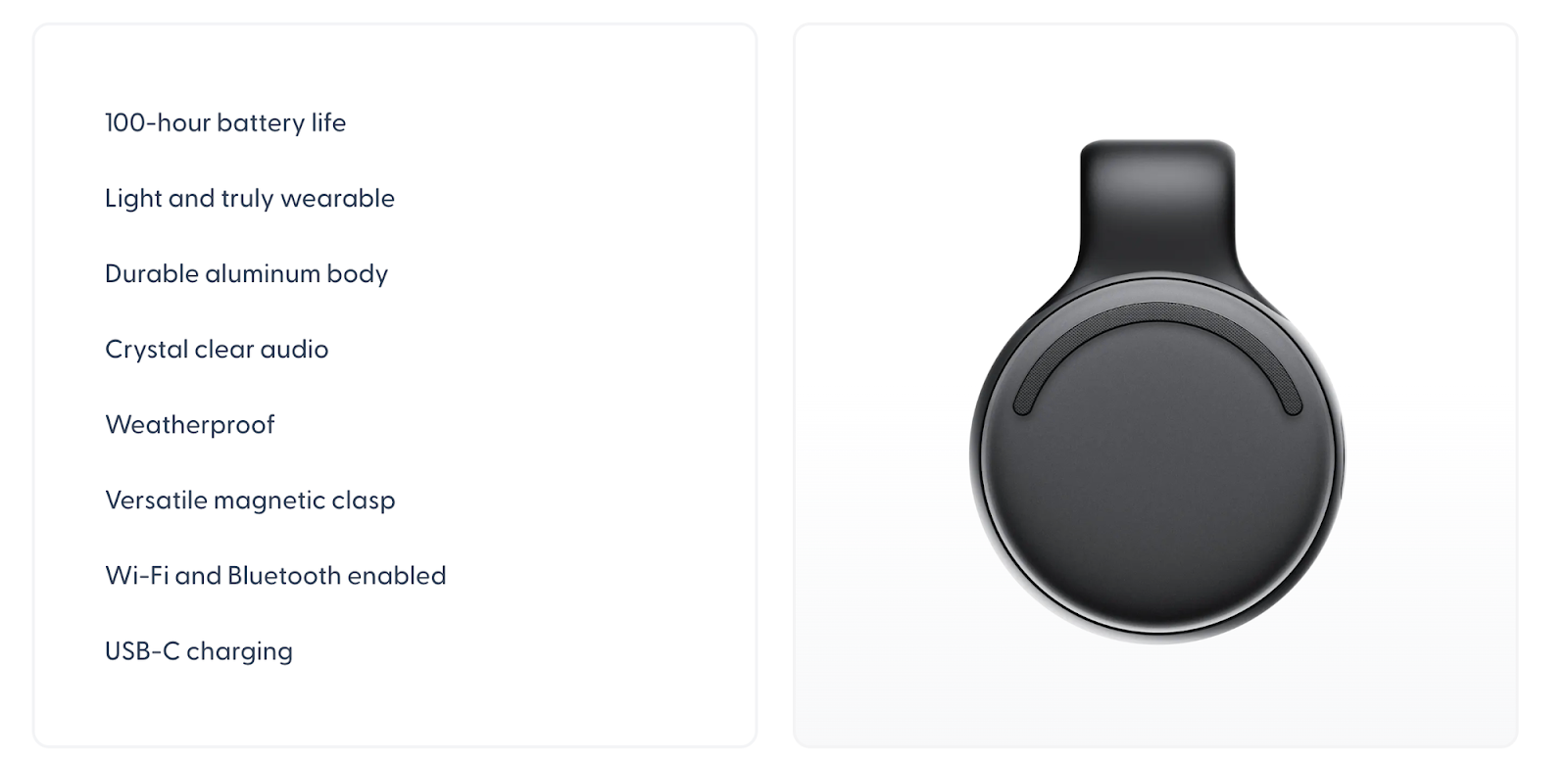

Limitless AI is designed to amplify the human brain. The product is trained to remember everything happening in your life: what you see on your computer or smartphone screen, what you say during calls or conversations throughout the day, etc. It then allows you to instantly access and contextualize all this information, enabling you to ask questions about it, similar to ChatGPT.

The product works in multiple environments: on your laptop, smartphone, and even in the real world as a wearable device. Here’s a video presentation of the product.

Limitless AI stands out with its impressive concept and experienced team, entering a niche that large players will likely avoid for years due to privacy and brand risks. The company has shown solid traction, with an ARR of about $2 million. Its most recent funding round valued the company at $350 million, a clear signal of confidence in its potential.

Products aiming to replace entire professions

A fascinating category involves products trying to replace entire professions—not just serving as assistants or “copilots,” but full-on replacements.

A prime example is Cognition Labs, which is developing Devin, an AI programmer. In a recent conversation, prominent investor Vinod Khosla mentioned they’re also backing the development of an AI structural engineer. Another example is Airs AI, which is building an AI salesperson that can make sales calls and close deals.

This category represents high-risk, high-reward ventures with significant technical challenges—true venture capital stories.

A radical AI project rethinking children’s education

One particularly interesting project is rethinking the role of teachers in schools by redistributing many of their responsibilities.

The modern teacher’s role is incredibly multifaceted: motivating students, delivering lectures, helping them practice, grading assignments, supporting struggling students, maintaining order in the classroom, and much more. It’s nearly impossible to train enough professionals to meet the educational system’s needs at this scale, leading to diminished education quality.

What if software and other people (without specialized skills) could take over some of these functions? Generative AI could handle delivering lectures, adapting examples to student levels, and practicing new information (Khan Academy has already demonstrated this is possible). Lower-skilled people could motivate students, create a positive environment, and maintain order.

This approach would allow teachers to focus on more complex and impactful aspects of the educational process, such as helping struggling students, solving advanced problems, and tackling deeper topics. While this would require more specialized teacher training, it would free up their time for the most crucial and high-impact activities.

One AI project has taken an even more radical approach, completely removing teachers from the educational process and using AI to handle the core functions. Although still in the early stages and tested at only one institution, the project has shown highly promising early results.

Conclusion

This article originated from my notes where I attempted to organize my thoughts on what makes sense to build with the new wave of AI technologies.

I’m sure you have thoughts on this subject as well, perhaps even noted down in a similar format. I’d love to hear them, and perhaps together we can refine or expand on this topic. Feel free to reach out at oleg@gopractice.io.

As of now, my categorization of which AI products people with a product background should and shouldn’t pursue is as follows:

AI products not worth creating

- Foundational tech products, as well as mass-market B2C products derived from them

- Wrappers

- New products in niches where existing players are already implementing AI

- Products aimed at AI developers

AI products worth creating

- Products for automating manual processes in large companies

- Vertically integrated solutions

- Service industries that can be productized with AI

- Fundamentally new AI-first products

Sources for this piece and other noteworthy articles and videos

- Building AI products, Ben Evans

- Looking for AI use-cases, Ben Evans

- AI: Startup Vs Incumbent Value, Elad Blog

- Better AI Models, Better Startups, Y Combinator (YouTube)

- Vinod Khosla on What to Build in AI, More or Less Podcast (YouTube)

- Elad Gil on What to Build in AI (Part II), More or Less Podcast (YouTube)

- How AI Could Save (Not Destroy) Education | Sal Khan, TED (YouTube)

- The AI Workforce is Here: The Rise of a New Labor Market, Nfx

- Artificially Intelligent Barbarians, Andrew Ziperski, Substack

Learn more

All posts from the series

- How to choose your first AI/ML project: a guide

- How to discover potential AI applications in your business

- How we turned around an ML product by looking differently at the data

- Large language models: foundations for building AI-powered products

- Improve Retention by using ML/AI: what to do and what not to do

- Basic guide to improving product quality with LLM

- Advanced methods for improving product quality with LLM: RAG

- Why an ideal ML model is not enough to build a business around ML

- What to build and not to build in AI

- How to use AI for product and market research

Illustration by Anna Golde for GoPractice