“You never know who’s swimming naked until the tide goes out.”

― Warren Buffett

The last few years were big for non-gaming subscription-based apps in the Apple App Store. During this period, lots of simple apps started making millions of dollars per month.

For example, Celebrity Voice Changer makes over $3M per month and raked in almost $30M in the past few years. QR Code Reader by Tinylab made over $800K last month and over $13M over the last few years. An app called Life Advisor generated over $1M in revenue in the last month alone.

Some of the companies developing pretty basic apps have even become unicorns. In February, Calm raised $88M in funding at a $1B valuation. The maker of Facetune app raised $135M at a unicorn valuation In July.

But how do they do this?

These apps aren’t powered by any innovative technology; they don’t have network effects; and they are pretty easy to copy. So what is their secret sauce? Subscriptions. To be more specific, the obscure way that subscriptions used to work in iOS.

I said “used to work” because Apple made a small change to subscriptions in iOS 13, the latest version of its mobile operating system. This change went unnoticed by media outlets covering iOS 13’s release, but I believe it will have a profound impact on the mobile apps ecosystem in the Apple App Store.

In this article I will use revenue and downloads estimates provided by Datamagic to explain why I believe the following will happen after Apple’s new adjustment to iOS app subscriptions:

- The revenue of Calm and Facetune on iOS will drop by a factor of 2-4, and they won’t be able to justify 1B valuation.

- Lots of sneaky subscription apps will first stop growing, and then disappear altogether from the App Store over time.

→ Test your product management and data skills with this free Growth Skills Assessment Test.

→ Learn data-driven product management in Simulator by GoPractice.

→ Learn growth and realize the maximum potential of your product in Product Growth Simulator.

→ Learn to apply generative AI to create products and automate processes in Generative AI for Product Managers – Mini Simulator.

→ Learn AI/ML through practice by completing four projects around the most common AI problems in AI/ML Simulator for Product Managers.

Only 59% of the top 100 Grossing apps on the Apple App Store are games compared to 90% on Google Play

As of the end of September 2019, 90% of the top 100 grossing apps in Google Play in US are games. In contrast, only 59% of the top 100 grossing apps in the App Store are games. This contrast becomes even more evident if we compare the share of gaming apps in the top 200 or 500 grossing apps on each platform.

But why is there such a big difference between the two major app stores in the US?

Оne could say that iPhone users are different from Android users: iPhone users play games less, and meditate and work out much more than Android users.

Believe me, this is not the case.

Interestingly, of the 41 non-gaming apps in the top 100 grossing on iOS, only 15 are also included in the top 100 grossing on Google Play. 97% of these apps are monetized through subscriptions.

The truth is, the difference between how subscriptions work in the two platforms gives iOS apps an unfair advantage. Here’s why.

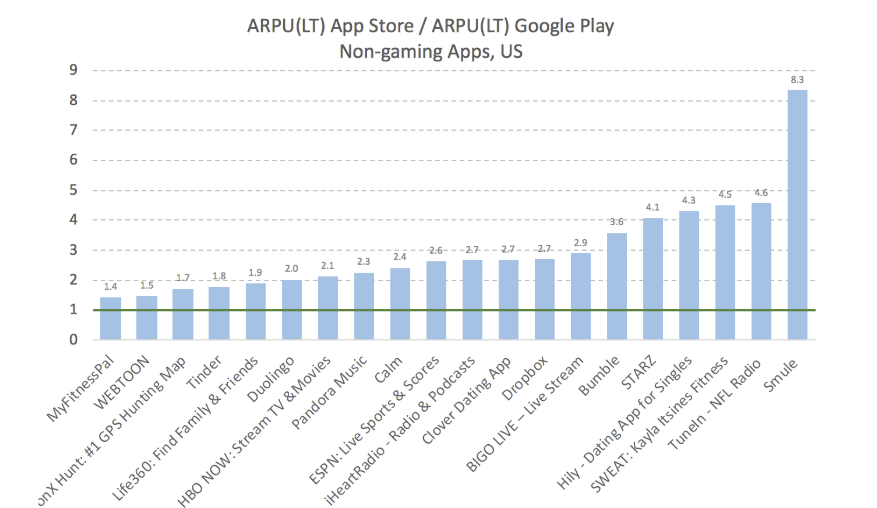

ARPU of apps monetized through subscriptions is 2.5-25x higher on iOS than on Android

Let’s see how big is the advantage that mobile apps monetized through subscriptions in App Store have over Google Play apps.

We will calculate the ratio of Lifetime ARPU (lifetime revenue divided by lifetime downloads) of different apps in App Store and Google Play in the United States. For this, we will use a mobile market intelligence tool called Datamagic, which provides download and revenue estimates for mobile apps.

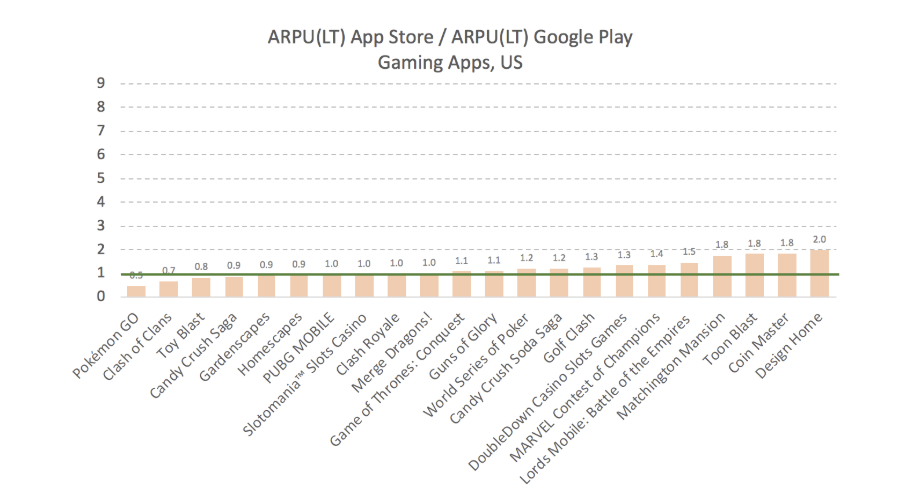

But before we get to non-gaming subscription-based apps, we need to get a benchmark to know what is the normal difference in monetization between Google Play and App Store.

On the chart below, you can see the ratio of ARPU(LT) on App Store and Google Play in the US for several popular gaming apps from the top 100 grossing chart. As you can see, the monetization of gaming apps is similar on both platforms. The ratio of most of the apps is clustered around 1.1. A few outliers have a 2x difference.

It seems to be a reasonable estimate. According to a report by mobile ad monetization firm Appodeal: “In the U.S., rewarded video eCPMs increased significantly, with an average of $13.75 on iOS and $12.01 on Android”. CPM is a good proxy for monetization of apps and based on the data above there is a 14% difference between iOS and Android in the U.S.

Let’s do the same exercise for non-gaming apps from the top 100 grossing chart in the App Store for US. I have excluded apps that do not monetize through in-app purchases in Google Play.

Most of these apps are generating 2.5-8 times more revenue per download on App Store compared to Google Play in the US.

As we have seen before this cannot be attributed to the difference between the platforms in the US, because gaming apps have similar monetization on the App Store and Google Play. Neither this can be explained by the difference between the iOS and Android versions of the apps—they are usually identical on both platforms.

The only difference is in the subscription models—or namely, how subscriptions work on iOS.

*There are some outliers that I didn’t add to the chart. For VSCO the ratio is 24 and for Plenty of Fish Dating the ratio is 380.

What’s wrong with iOS subscription-based apps?

First, it’s important to know that there are many useful and high-quality apps that monetize through subscriptions on iOS.

In fact, many of the apps in the top 100 grossing chart are very useful. They generate more revenue than they should on iOS (we will get to this later), but their teams’ goal is to build high-quality services and provide value to end users.

A suitable real-life analogy for some of these apps would be fitness gyms. Fitness gyms don’t do anything bad. Neither do they deceive their customers. But many of their customers purchase a three- or six-month membership, and then stop going to the gym after a couple of sessions.

However, if you go beyond the top 100 grossing, there will be lots of sneaky scammy apps that provide almost no value and only exploit the subscription system to intentionally deceive users.

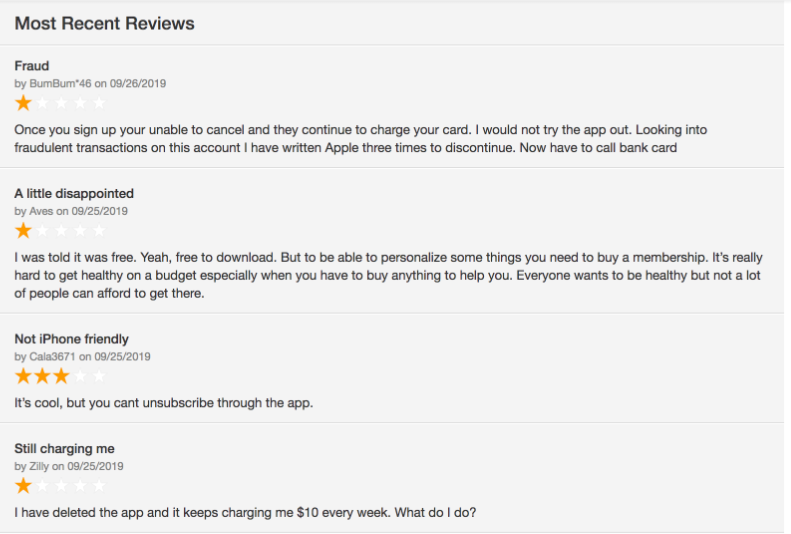

Such apps are pretty easy to spot. They usually have lots of negative reviews with angry people demanding refunds and complaining that they keep getting charged after deleting the app. You usually won’t see these reviews on App Store page, because the developers are smart enough to buy good reviews to bury the bad ones. But when you look up these apps on Sensor Tower, everything becomes clear pretty quickly.

You can find more examples of scam apps here.

What’s wrong with iOS’ subscription system?

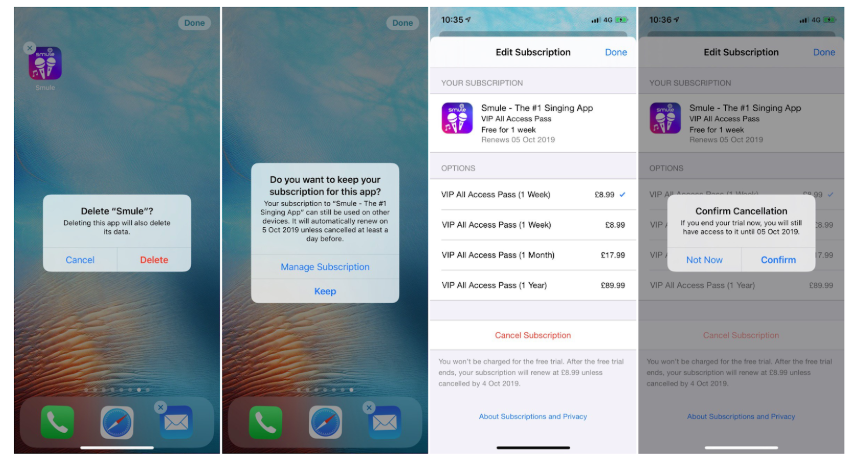

When you register for a subscription or a free trial in an iOS app and then delete the app, your subscription remains active. This means you will keep getting charged until you figure out that you have to go to the App Store settings and turn off the subscription.

The probability that a regular user will know this is close to 0. Even people working on iOS apps often don’t know about this.

Why did Apple design subscriptions to work in this way? There are a few possible explanations.

First, users might have several devices and use an app on all of them. In this case, it would make sense to not cancel a subscription if the users delete an app on one of their devices but keep it on others.

Second, revenue from subscription-based apps was one of the main drives of the revenue growth of the Apple App Store in the past several years.

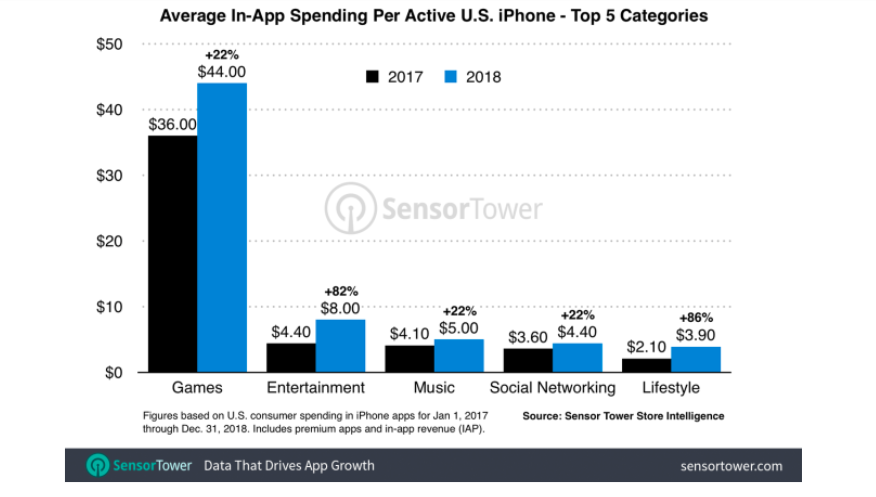

Per Sensor Tower data, the average spending per active device in the App Store’s gaming category increased by 20% in 2018. Meanwhile, in categories dominated by subscription-based apps, the growth has been considerably higher. Two examples are the Entertainment and Lifestyle categories, which respectively grew 82% and 86% in 2018.

The impact of subscription-based apps on the App Store’s revenue also becomes evident when comparing the percentage of non-gaming apps in the top 100 grossing charts of the App Store and Google Play.

This data indicates that subscription-based apps play a significant role in helping increase iPhone consumer spending. Considering the slowdown in iPhone sales and Apple’s focus on growing revenue from services, Apple’s team might have turned a blind eye on the fact that iPhone users don’t understand how subscriptions work and some developers are exploiting it for their own benefit. Turn a blind eye or kill one of the main growth drivers? What would you choose?

What has changed in iOS 13?

The way subscriptions work in iOS 13 is different: When you delete an app with an active subscription, you will now see a system popup asking if you want to cancel the app’s subscription.

It’s still not super-easy to cancel subscriptions even with the help of this popup, but at least people will now become aware that they are still subscribed to the app even after deleting it.

Subscription-based apps will see a 2-8x drop to their iOS revenue in the next few years

It is still too early to evaluate the impact of the change to the way subscriptions work in iOS 13. However, I expect that it will solve the problem of people not understanding that they will keep on paying for an app even after deleting it. In the best case, the monetization of iOS’ subscription-based apps will become similar to their Android versions.

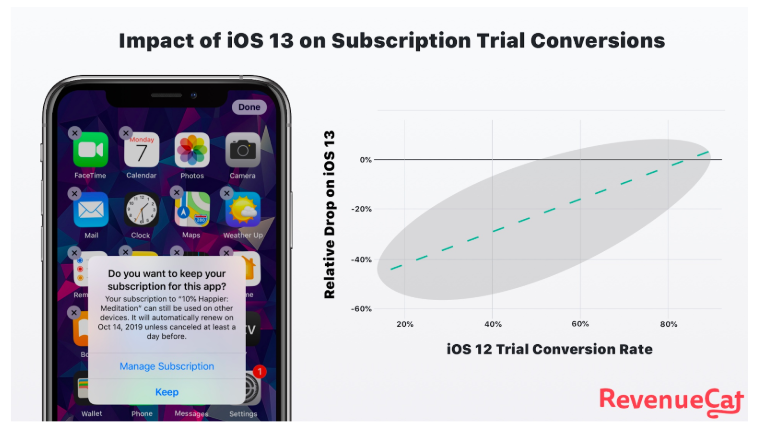

The first signs are promising. RevenueCat looked at the difference in trial conversion rate between iOS 12 and iOS 13. 80% of the apps they looked at showed a statistically significant decrease in trial conversion rate for users on iOS 13 vs iOS 12. RevenueCat measured an average drop of 9% in absolute conversion rate, which translates into a median relative drop in a conversion rate of 29%, but with a pretty wide range depending on the app, anywhere from 0% to 60%.

But we should keep in mind that the overall impact on the revenue of the subscription-based apps will be delayed for a few reasons.

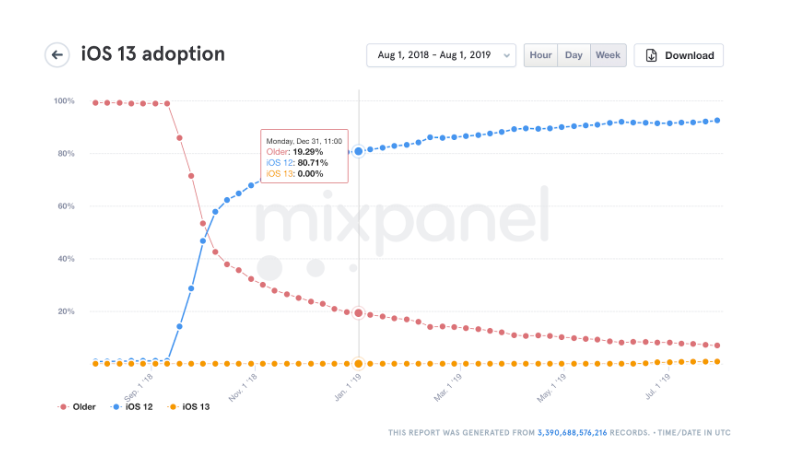

First, iOS 13 adoption rate was only 25% as of the end of September 2019. It will only reach 80% by the end of 2019 (based on how iOS 12 was adopted).

Second, most subscription-based apps have already reached a significant number of active subscribers. They won’t be affected by this change and will keep generating revenue.

But even though the impact of the iOS 13 change will be delayed, it will still be massive if our assumption that the revenue of App Store’s subscription-based apps will reduce to the level of Google Play is even half true.

There are few areas which will be impacted:

- LTV of new users will drop significantly, which will impact the revenue from new users (by 2.5-8x depending on the app)

- Many subscription-based apps are aggressively engaged in paid user acquisition. If the LTV of these apps drops by as much as we predicted above, then the volume of paid traffic they will be able to bring in will decline as well.

- Paid traffic often helps drive organic downloads through ASO mechanisms, so organic traffic should be impacted as well.

- If LTV gets significantly smaller, then App Store will feature these apps less frequently, because there will be others with better performance metrics.

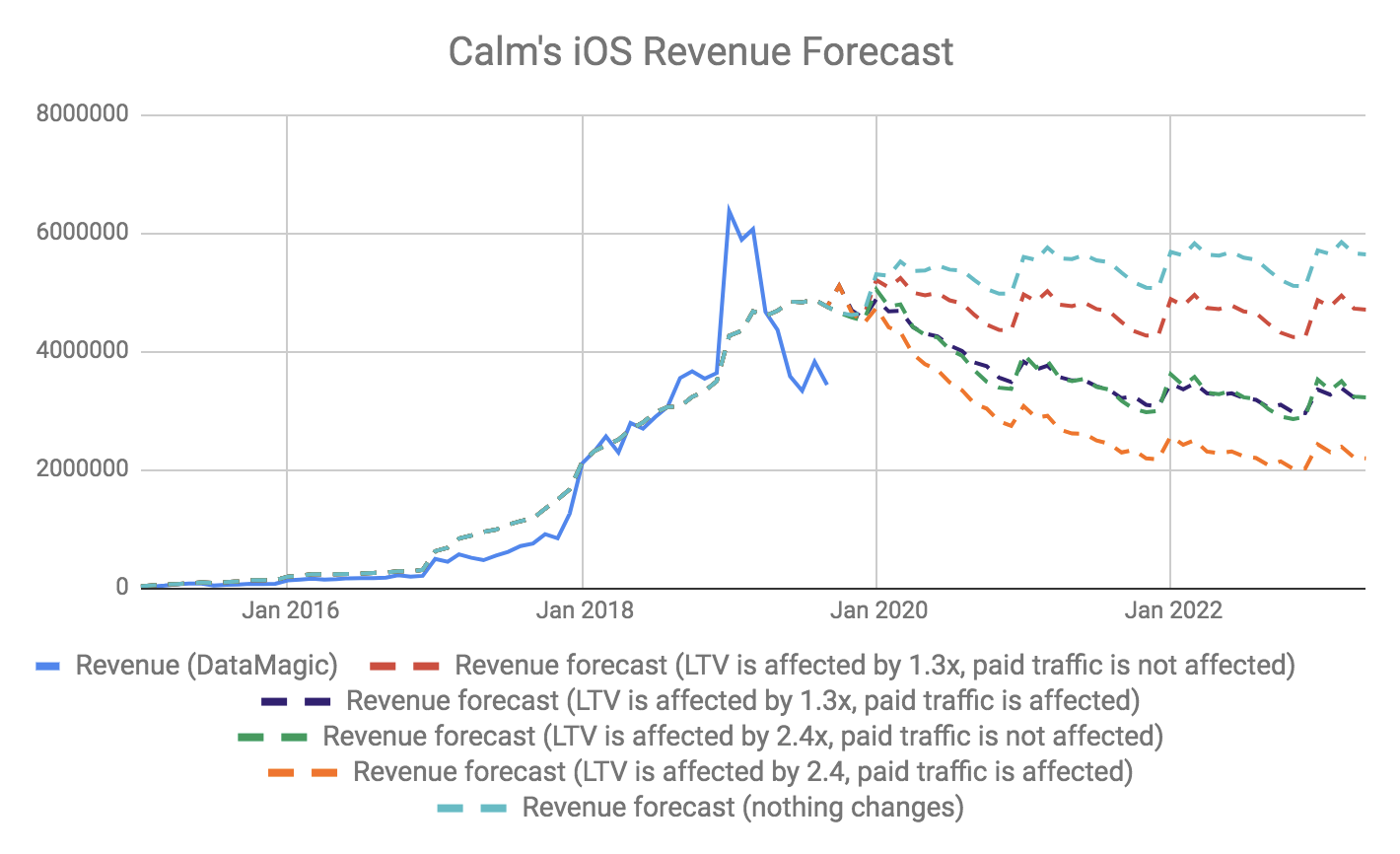

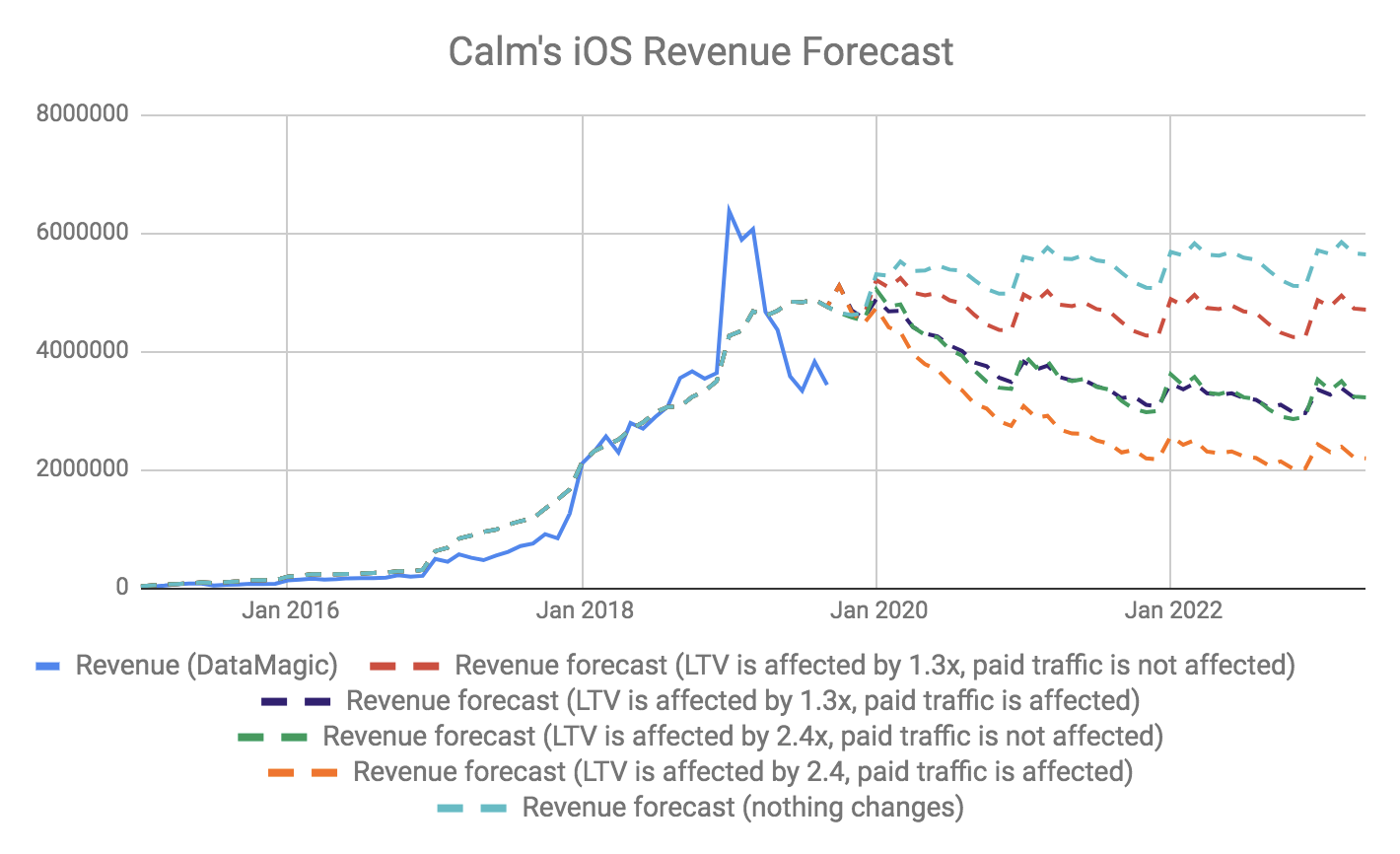

Forecast of Calm’s iOS revenue in the coming years

Let’s see how these changes will impact Calm.

Below you can see Calm’s revenue for the last couple of years based on Datamagic.

Calm is making ~850k per week on Apple App Store and ~230k on Google Play.

Now we will need to make a few assumptions:

- Scenario #1: iOS 13 change will drop Apple App Store monetization level to Google Play level (for Calm the ratio based on US data is 2.4)

- Scenario #2: iOS 13 change will drop Apple App Store monetization level by 1.3x (based on the median drop of trial conversion rate in iOS 13 based on RevenueCat data)

- 50% of downloads for Calm’s iOS version come from paid ads.

- The amount of paid traffic is linearly dependent on LTV (if LTV drops by a factor of 3, then the amount of paid traffic will drop by the same amount – it’s a simplification, but it works here).

- iOS 13 will be adopted in the same way as iOS 12.

In case the above assumptions are correct, Calm’s iOS revenue in the following years will look like the following chart.

* The big difference in Jan-Sep 2019 period is because Calm mostly sells yearly subscriptions, but in the model, I distributed yearly subscriptions revenue over 12 months. That is why the revenue forecast based on Datamagic data goes higher than the forecast in Jan-Apr 2019 period and then lower than the forecast in May-Sep 2019.

* You can see the calculations here.

In the worst-case scenario, when LTV and paid traffic are affected, iOS revenue will drop by almost 2.5 times in the next few years. It’s unlikely that with such revenue dynamics Calm will be able to maintain its $1B valuation.

Even in the realistic scenario with LTV dropping by 1.3 times and paid traffic being affected, revenue stop growing in the short-term and drops in the long-term. Again, it’s unlikely that Calm will be able to justify $1B valuation in this case.

Another interesting fact is that, in case nothing changes, revenue growth will slow down significantly. Maybe that’s what Apple App Store executives expected and that’s why they decided to make the change now.

Conclusion

Since Apple has rolled out iOS 13 just recently, we don’t have factual data on how the changes made to subscriptions will affect the monetization metrics of subscription-based apps. However, if my predictions are correct, the impact will be significant.

And it will impact both:

- companies building useful apps that monetized through subscriptions

- sneaky scammy apps that used subscriptions to deceive users

However, I believe that Apple should have made this change a long time ago. That way, the App Store would not have been flooded with lots of products from the second category (sneaky scammy apps), and the companies from the first category (useful apps) would not be overvalued (which might create problems for them in the future).

→ Test your product management and data skills with this free Growth Skills Assessment Test.

→ Learn data-driven product management in Simulator by GoPractice.

→ Learn growth and realize the maximum potential of your product in Product Growth Simulator.

→ Learn to apply generative AI to create products and automate processes in Generative AI for Product Managers – Mini Simulator.

→ Learn AI/ML through practice by completing four projects around the most common AI problems in AI/ML Simulator for Product Managers.