In late 2013, Fab, a fast-growing e-commerce startup that had raised $330 million in funding, realized that it had a serious problem: Its business model wasn’t working. The company started on a downward sloped that began with laying off many employees (including its co-founder). In 2015, the company, which had been valued at more than $1bn, was acquired by PCH Innovations for a mere $15 million.

What went wrong? Well, like all commercial failures, Fab’s story is complicated and unique. But one recurring theme can be seen in the demise of this once-promising startup: over-reliance on paid marketing.

In this essay, I’ll talk about a growth model based on paid marketing. I will discuss the limitations and the hidden risks of these models, and the consequences of ignoring these risks. I will also discuss how to make the growth model based on paid marketing sustainable and secure.

Let’s assume you’ve reached the product/market fit, which means your product generates value for a specific market segment. You’ve also found the advertising channels where LTV (Lifetime Value) of the acquired users exceeds CAC (Customer Acquisition Cost)—you have created effective channels for delivering the product to your target audience.

That’s great news because few products get this far. The vast majority get eliminated from the race at earlier stages. But it’s not yet time to sit back and relax. There are new dangers ahead, especially if the product’s growth becomes highly dependent on paid user acquisition channels.

→ Test your product management and data skills with this free Growth Skills Assessment Test.

→ Learn data-driven product management in Simulator by GoPractice.

→ Learn growth and realize the maximum potential of your product in Product Growth Simulator.

The hidden risks of growth models that rely on paid advertising traffic

You’ve finally found a scalable growth channel through paid ads. The first tests show inspiring results: your CAC (Customer Acquisition Cost) payback time is eight months, and the predicted LTV (Lifetime Value) exceeds the CAC by a factor of two.

The team makes a reasonable decision to focus on getting the most value out of the effective distribution channel they’ve found, temporarily lowering the priority of other marketing and product activities:

- The marketing team now focuses on increasing the volume of the paid traffic by optimizing the acquisition funnel and searching for new advertising channels.

- The product team focuses on growing LTV by optimizing key product flows and features.

- The CEO focuses on raising a new round of funding to accelerate growth (CAC payback period is eight months, so additional funds are needed for an aggressive growth).

The above steps are quite logical. However, it is very important to be aware of the hidden risks that arise when paid marketing channels become the key growth driver of a product:

- Paid marketing doesn’t scale with product growth.

- Advertising channels tend to saturate over time.

- Others can easily copy a growth model that relies on paid marketing (both at the marketing and product levels).

- Your interests and those of advertising networks differ greatly.

But this doesn’t mean you should avoid this growth model. By paying due attention to the risks described above during planning time and while raising money, you can build an effective growth model based on paid marketing that will help to achieve your goals. But if you neglect these hidden risks, you might get into trouble.

Hidden Risk 1: Paid marketing does not scale with product growth

One of the characteristics of paid marketing is that scaling the traffic acquisition and growing your business are two very separate processes. This entails both an advantage and a disadvantage.

The advantage is that at the start, paid ads can give you a quick and powerful boost through the rapid increase of acquired traffic volume. The disadvantage is that you cannot constantly increase the number of new users from paid ads and over time, the effectiveness of these growth channels will wane.

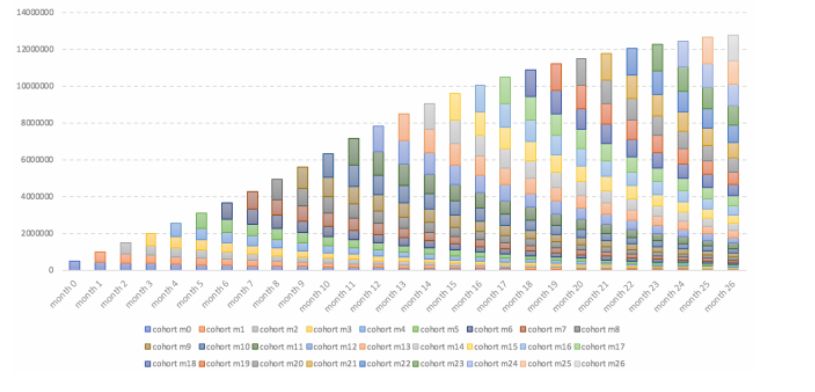

Let’s look at an example about a mobile game that grows through paid marketing:

- The team acquires new users through paid ads.

- The cohort acquired within the launch month brings in $500,000 in the same month.

- The mobile game has a phenomenal retention rate and great monetization, so the first cohort’s monthly dynamics looks like this: $500,000, $450,000 (90% of the previous month), $405,000 (90% of the month before that), and so on.

- Both marketing and product teams perform well and manage to regularly improve the effectiveness of the key funnel. During the first year they steadily increase the volume of the purchased traffic, which ensures the 10% revenue growth of cohorts from subsequent months (the first cohort’s revenue was estimated at $500,000, the following cohort’s revenue $550,000 and so on).

The revenue growth dynamics of this game will look like this:

On the pic: Revenue growth demonstrated in monthly cohorts

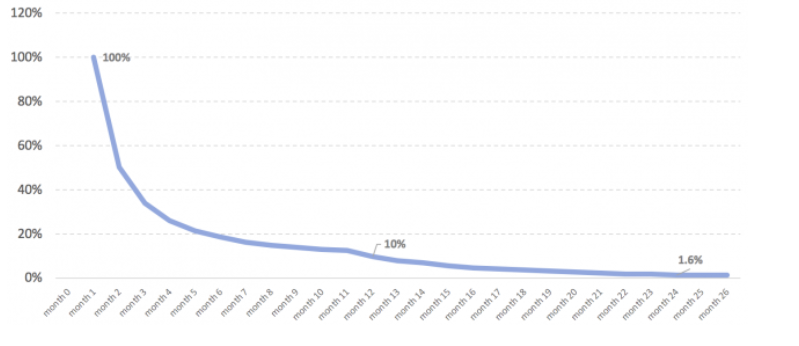

In this scenario, the game’s growth in the second month will exceed 100%. But in the following year, the growth rate will drop to 10% month over month, and in two years it will be as little as 1-2% month over month.

On the pic: Monthly growth

Even in an optimistic scenario where the team is making regular progress, in two years’ time, the paid marketing channels won’t be able to drive growth any longer.

The reason for the slowdown is that paid marketing channels do not scale with the product growth. Now, try to compare this to the following growth models:

- A referral growth channel in Dropbox where users invite their friends to the product in exchange for additional storage space.

- SurveyMonkey’s viral growth channel, where users not only receive poll results’ when sending out their surveys, but also promote the service itself (when a user finishes the survey she is offered a link that encourages her to create her own survey on the platform).

- The content growth loop of Medium, where users create content that is later indexed by search engines, increasing the influx of the new users via search traffic, which leads to an increase in the number of users who eventually create more content. Medium has another similar growth loop, in which content creators promote their articles and bring new users to the platform.

The main feature of the growth models described above is that they scale in parallel to the product growth:

- As more people use Dropbox, more users participate in the referral program, inviting their friends to the service.

- As more people use Surveymonkey, they send more polls, therefore more users learn about the service and sign up with it, and as a result the service’s audience increases.

- As more people publish content on Medium, the platform receives more traffic, i.e., more users create blogs on the platform and start to use it to publish content and distribute it on their own channels, promoting the platform in the process.

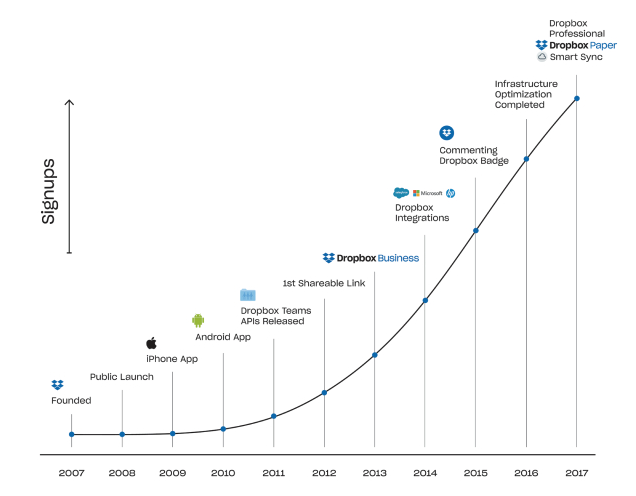

The growth channels in the examples above scale in tandem with the product’s growth (they have limitations of course, such as the market size, competition, etc.). Products that are built around such channels usually grow slowly at the beginning. But as their audience builds up, their growth channels gain momentum and drive exponential growth.

Below, you can see Dropbox’s growth chart. Note the exponential growth in the number of new users per year in the first 6-7 years.

In cases where the dependence on paid marketing channels is significant, you can see an inverse trend. In this case, the growth curve is logarithmic: We can see a rapid growth in the beginning that gradually plateaus. It becomes impossible to accelerate growth at a certain point because it’s impossible to scale the volume of paid traffic (we will talk about the reasons behind it a bit later).

Below you can see Calm’s growth over the past four years. We can observe two spikes that demonstrate the increasing number of acquired users with a subsequent plateau. Feel free to read more here.

Hidden Risk 2: Paid marketing channel saturation

The Golden Cohort is a group of early adopters of your product. The Golden Cohort is usually more engaged and has a better retention than those who come after.

The Golden Cohort’s principle works not only for the product itself, but also for the advertising channels: The first users from a certain advertising channel in most cases will also be more engaged and have a better retention than the ones who come from the same channel later on.

There is a simple explanation for this. The first users from the new ad channel are the most relevant users from your target audience. They’ve reacted to your marketing message faster than others did (i.e., it took less impressions per user to acquire them).

As you keep on investing more in the advertising channel, you will notice two processes happening at the same time that will deteriorate the unit economy and ROI (Return on Investment):

- There will be less and less relevant users from your target audience in the channel, which means it will become harder (i.e., more expensive) to find and acquire users there.

- At some point, you will notice that the users you acquire through the paid channel are reacting worse to your ad messaging and are less engaged in the product.

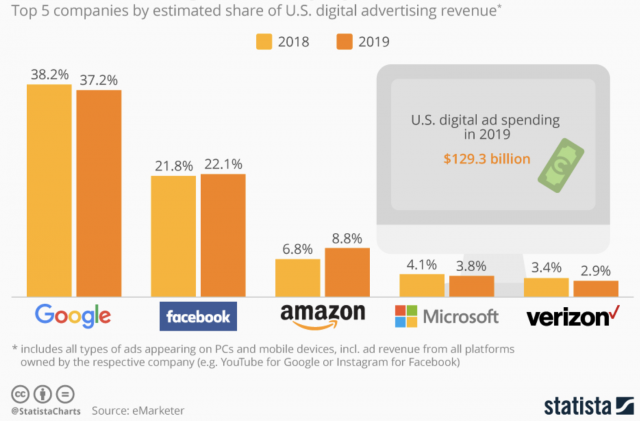

The saturation process described above has a different degree of influence on different advertising channels. However, it is almost always present in one form or another. Given the limited number of advertising channels in the world nowadays (Google and Facebook own 60% of the Internet advertising market in the US; 75% of the market is distributed among the top five players), any product will inevitably reach a saturation point.

Hidden risk 3: Advertising growth channels are easy to copy

As soon as the market notices the first signs of your new product’s success, clones will emerge out of nowhere.

Not only will they copy your product, but they will also copy your marketing strategy. Usually the marketing strategy gets copied almost instantly (unless you’ve invested in a smart automated traffic management system that is deeply integrated with the ad networks). Copying the product is a bit more complicated. Here, everything will depend on its complexity and defensibility.

The new players in the market will trigger an escalating competition in paid marketing channels, which will in turn increase the CAC (Customer Acquisition Cost). The appearance of similar services will also lure some of your current users to your product’s competitors, making key product metrics look worse. The unit economics of paid advertising channels will start to deteriorate, making your first test campaign’s ROI estimations irrelevant.

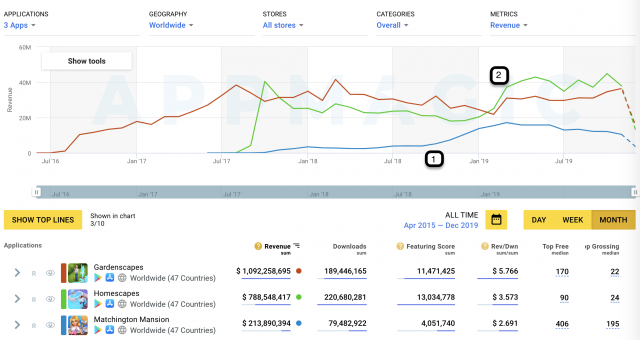

Here is an interesting example of cloning a product and a subsequent marketing war between two game developers, which affected everyone involved in the casual games market. I recommend reading the complete essay here, but a short outline follows:

- At the beginning of 2019, Playrix was one of the leading companies in the casual mobile games market.

- At the time, Firecraft Studios was a newbie in the mobile gaming market. A little over a year earlier, they had launched their first Matchington Mansion title, which was basically a clone of Playrix’s title (copied at the product level).

- At the end of 2018, Firecraft Studios started to aggressively scale Matchington Mansion mostly through paid marketing. By February 2019, the game’s revenue was nearly matching Playrix’s leading games.

- Playrix realized they were losing their market share and responded by pushing their installs to an all time high, starting a war for the same female player base (heating up an ad auction).

- This paid-traffic war affected other market participants. The gaming company Glu Mobile referred to the aggressive UA campaigns from the two casual game publishers in their Q1 Earnings Call Transcript, which prevented the company from achieving their goals in respect to their female-centric titles (all market participants suffered from a heated ad auction in this case, while the advertising networks became the big winners).

- During this fight, Firecraft Studios came up with a new interactive type of ad that didn’t not refer to gameplay. This allowed them to gain an advantage in terms of CAC (new marketing strategy).

- In order to defend themselves, Playrix quickly copied this approach, neutralizing the advantage of the aggressive competitor (copying at the marketing level).

- Feel free to read the full version with a detailed analysis here.

Hidden Risk 4: Your company and ad networks have conflicting interests

A more fundamental problem with being dependent on paid marketing channels is that your main partner, which is the advertising network, is not really your partner. It may seem that your interests are aligned at first, but in reality they are not.

Your interests partially overlap in the fact that both you and the advertising system are interested in you purchasing as much traffic as possible.

At the same time, your interests directly conflict when it comes to the price for traffic acquisition, as this determines the profit distribution between you and the ad network.

The problem is that as soon as your growth becomes dependent on a certain advertising network (and there are not too many advertising networks nowadays), your opponent becomes stronger.

An increasing competition in paid ad channels (going back to risk 3 here) and the need to scale the paid acquisition (recall risk 2) will lead to higher CAC and force you to increase the CAC payback period. As the described processes develop, your profit will gradually lean toward zero, because it will start gradually moving into the bank accounts of the companies that own the ad networks.

If we look at what is happening on a global scale, then through a similar mechanism, Google and Facebook are gradually taking over the profits of the companies that are using their ad platforms to advertise their products.

The consequences of neglecting the risks of becoming dependent on paid marketing

Let’s look at a classic scenario in which the risks we’ve talked about in this essay can lead to negative consequences:

- The company launches a new product.

- After a while, the company finds advertising channels with a positive unit economy and starts scaling paid marketing. At the same time, both product and marketing teams devote most of their time to optimize the key funnel.

- Everyone enjoys rapid growth for a year or so.

- Against the backdrop of this rapid growth, the company attracts new funding at a high valuation because everyone expects them to keep accelerating their growth.

- Gradually, the risks we described above start to show:

- As the advertising channels scale up, they begin to produce smaller and smaller incremental growth.

- Competitors copy your marketing strategy and new players make similar products and join the game.

- Advertising channels start getting saturated and the unit economy starts to deteriorate.

- The company increases its CAC payback period from the initial eight to 12 months, and then bumps it up to 16.

- The product temporarily goes back to normal growth rates. Perhaps the company raises a new round of funding to solve the problem. But this will only relieve the symptoms without curing the main disease.

- As the company burns through its funding, money starts running low. At this stage it’s impossible to repeat the trick with increasing CAC payback period.

- The company can’t raise more funding based on its current valuation (the company’s growth has slowed down).

- The company leaves the battlefield for the market or closes down (like the numerous group-buying services that did several years ago).

- Facebook and Google publish reports with revenue growth of 40% year on year.

The scenario described above applies to companies that run on venture capital (VC), which are expected to have high growth rates over a very long period of time. It also demonstrates the most negative form of growth model dependence on paid marketing channels. Usually, it doesn’t look this scary. The main goal behind this fictional story is to show what happens when you ignore the risks we discussed above.

With proper financial discipline and good planning, paid growth channels are excellent tools for reaching the next stage in your company growth. To do this, you need to be aware that the potential behind the advertising channels is finite (i.e., you must keep on looking for and build some alternative growth channels), calculate the unit economy for the paid ad channels in the right way (it gets more difficult with budget growth), and keep an adequate level of profitability (or loss ratio).

When does a growth model based on paid marketing look robust and secure?

In a number of situations, the advertising growth model will be less exposed to the risks we explored in this article.

An advertising channel is used to launch other more sustainable growth mechanisms

Facebook aggressively invested in advertising channels in the early stages of its launch in new markets. Advertising channels served as a launchpad at the start and then switched towards a more supporting function later on. Long-term growth stability was provided by additional growth channels that kicked in at different times, such as word-of-mouth, virality, etc. The network effects provided safeguards that allowed the company to establish a monopoly position in the market. Facebook’s competitors had no obvious way to stop it (remember Google+).

In one of my previous essays, I shared a story about Sense, a time-tracking app that allows you to monitor the time you spend on social media. In this story, the advertising channel also served as a tool for launching organic growth mechanisms through search traffic in mobile app stores, and then took a supporting function as other channels provided sustainable growth.

The paid channel works alongside other sustainable growth channels

Wix is a website builder service that is actively investing in paid marketing channels, but is not dependent on it. When users sign up on a free tariff to create websites using Wix, people visiting their website will see a branding message that states it was built using Wix. This is the foundation of the platform’s viral growth channel.

Canva is a tool that allows people to solve design tasks using templates in an easy-to-use design interface. Canva creates a lot of templates and tools for all the possible problems people face (creating logos, stories, posters, banners, etc.). Further, the team promotes them through paid advertising channels to end users, and also focuses on optimizing templates for getting the SEO traffic. The acquired users make the growth model even more sustainable, being an entry point for further distribution in in their teams and companies.

An advertising channel will allow you to capture the market and establish a monopoly (or almost exclusive) position

In certain situations, capturing the market through aggressive paid marketing may be a reasonable strategy. For example, in situations where the market favors a monopoly, the entry threshold for new players is set very high or you have the opportunity to take over the market first, thereby limiting the growth opportunities of potential competitors.

In this case, the goal will be to capture the maximum market share and squeeze out your potential competitors. This will allow you to enjoy a monopoly position on the market in the future. This approach is capital-intensive and risky, but if it is properly implemented, it will yield good results. An example might be Didi’s clash with Uber over the Chinese ride sharing market, Uber’s exit from China, and Didi’s subsequent domination of the market.

The defensibility of the market position in this approach is ensured by having the first-mover advantage. If you were the first to occupy a certain market, then the cost of entering the market for future players who won’t bring any significant added value increases dramatically. This doesn’t mean that no one will try, but the cost of such experiments will be very high.

Summing it up

Growing through paid marketing is a great tool to achieve your goals. It is important to have the right expectations, but keep in mind the limitations of this growth channel and be aware of the risks of becoming dependent on it. In this case, you will be the one to benefit from the advertising networks, not the other way around.

→ Test your product management and data skills with this free Growth Skills Assessment Test.

→ Learn data-driven product management in Simulator by GoPractice.

→ Learn growth and realize the maximum potential of your product in Product Growth Simulator.