Product/market fit is an important concept when working on a new product. All entrepreneurs and product managers are committed to it. But if you ask what the term means, very few will be able to give a clear answer. Even fewer will have an understanding of how we can measure product/market fit using metrics.

Without a clear definition, even the most useful concepts will be of little help when making decisions. In this post, we will discuss some of the most common product/market fit definitions and their advantages and disadvantages, as well as tell you about PMFsurvey.com (Product / Market fit survey by Sean Ellis) developed in collaboration with GoPractice, which is designed to give you an objective metric of how close are you to Product / Market fit.

→ Test your product management and data skills with this free Growth Skills Assessment Test.

→ Learn data-driven product management in Simulator by GoPractice.

→ Learn growth and realize the maximum potential of your product in Product Growth Simulator.

→ Learn to apply generative AI to create products and automate processes in Generative AI for Product Managers – Mini Simulator.

→ Learn AI/ML through practice by completing four projects around the most common AI problems in AI/ML Simulator for Product Managers.

Criterion of product/market fit by Marc Andreessen

Marc Andreessen not only co-founded Netscape but also played a key role in creating the Mosaic browser. In 2009, Andreessen and his business partner Ben Horowitz created the Andreessen Horowitz venture capital fund. In one of his articles, Andreessen gave the following definition of what the product/market fit is—and what it is not:

“You can always feel when product/market fit is not happening. The customers aren’t quite getting value out of the product, word of mouth isn’t spreading, usage isn’t growing that fast, press reviews are kind of ‘blah,’ the sales cycle takes too long, and lots of deals never close.

And you can always feel product/market fit when it is happening. The customers are buying the product just as fast as you can make it — or usage is growing just as fast as you can add more servers. Money from customers is piling up in your company checking account. You’re hiring sales and customer support staff as fast as you can. Reporters are calling because they’ve heard about your hot new thing and they want to talk to you about it. You start getting entrepreneur of the year awards from Harvard Business School. Investment bankers are staking out your house.”

Pros:

- It gives you a vivid picture of what it means to reach product/market fit.

- It rarely fails when we talk about a team understanding whether they reached a product/market fit or not.

Cons:

- It mixes up two different things: distribution on the one hand, and creation of a product that meets the needs of a certain market segment on the other. For example, a team might create a useful product but fail to find effective distribution channels for it. The reverse is also true. A team might boost a weak product’s growth by ineffectively investing lots of money and create a false impression of product/market fit.

- It’s a binary definition, painting the scene only black and white. The description gives the impression that the product can be in one of two states: reached PMF or failed to do so. PMF is more like a gradient, and there are different levels of achieving it.

- It doesn’t provide any advice on the steps you should take if you haven’t yet reached product/market fit.

Product/market fit criterion by Sean Ellis

Entrepreneur and angel investor Sean Ellis proposed a survey approach to understand product/market fit. As VP of Marketing, Sean brought several companies to IPO (LogMeIn and Uproar.com), and built growth teams in Dropbox and Lookout. He coined and popularized the term “growth hacker.” Here’s what he has to say about product/market fit:

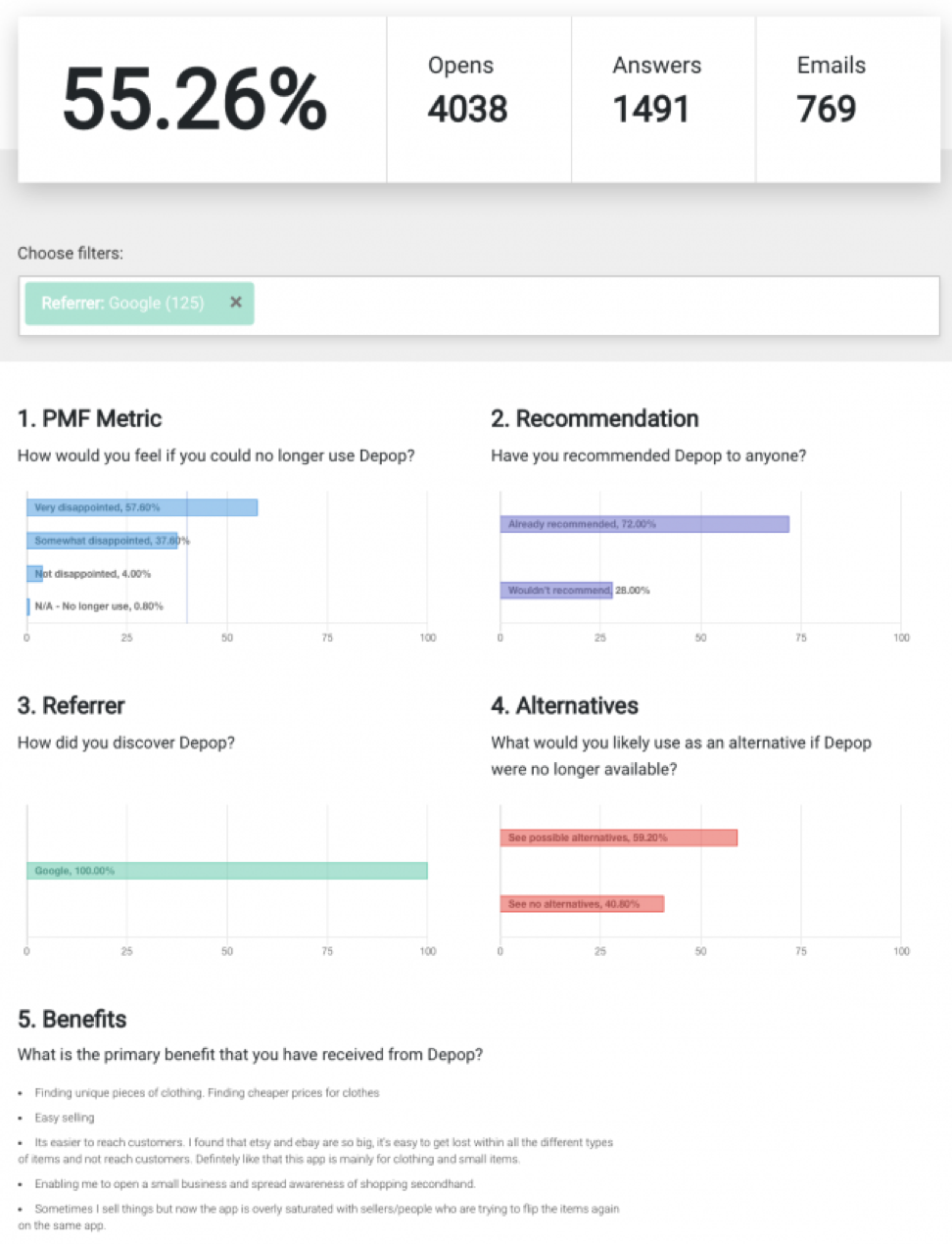

«PMFsurvey.com was designed to give you an objective metric that removes any emotions from the scaling decision while also giving you other important qualitative information. The key question in the survey is:

How would you feel if you could no longer use [product]?

- Very disappointed

- Somewhat disappointed

- Not disappointed (it isn’t really that useful)

- N/A – I no longer use [product]

If you find that over 40% of your users are saying that they would be “very disappointed” if they won’t be able to use your product, there is a great chance you can build a sustainable, scalable customer acquisition growth on this “must have” product. This 40% benchmark was determined by comparing results across 100s startups. Those that were above 40% are generally able to sustainably scale the businesses; those significantly below 40% always seem to struggle.

I recommend sending the survey to a random sample of people who have:

- Experienced the core of your product offering

- Used your product at least twice

- Used your product in the last two weeks»

Sean Ellis’ approach to measuring product/market fit got renewed attention after the publication of “How Superhuman Built an Engine to Find Product/Market Fit” by Rahul Vohra, the CEO of Superhuman.

In the article, the author describes that before reaching product/market fit, Superhuman built a process of working on its product to improve the metrics mentioned in Sean Ellis’ approach. The process changed their growth trajectory and boosted the product team’s morale.

Vohra’s approach builds on Sean’s original definition of product/market fit. But it is a bit refined and provides better guidance on what to do at each step and how to work with the results.

Vohra suggests the following:

- To measure the product/market fit of each new version of the product, you should send the survey to new users who have experienced the key value of the product.

- You need to segment users to understand the portrait of those who are most interested (users who will be very disappointed if the product ceases to exist). It is necessary to deeply explore their needs and understand what attracts them to the product.

- You should also work with the feedback from users who have something holding them back from getting the maximum value from the product (users who would be somewhat disappointed if they would no longer be able to use your product). But it is important to listen only to users who share the values and needs of the target audience (see the previous paragraph). If you remove the blocking elements that stop them, you will increase the conversion from new to loyal users.

- Do not pay attention to the feedback of users who won’t be disappointed if they could no longer use your product. Also, do not pay attention to the feedback of users who will be somewhat disappointed if they will no longer be able to use your product but do not share the values and needs of the target audience. This is not your audience, and at this stage, there is no point in further exploring their needs.

- Build a roadmap around investing in the things people already love about your product. Also focus on those people who share the values and needs of your target audience but are faced with barriers to getting the maximum value of your product. Removing those barriers should be part of your roadmap.

After this article, we (the GoPractice team) built the PMFsurvey.com service together with Sean Ellis, which allows any product team to easily reproduce the process described above.

With PMFsurvey, you can create a survey from Sean Ellis in one click, then send it to your users (the survey is automatically translated into all major languages). You can then analyze the results and receive product insights with the help of a convenient visual interface. You will be able to easily filter different user segments and get insights that will drive your product development process.

Pros

- A great advantage of this approach over the first one is that there is a metric for assessing the product/market fit and its target value.

- Using a metric to express the product/market fit makes it possible to segment the audience and draw conclusions about whether the product works for each segment. Again, I recommend reading the article from the Superhuman’s CEO. There you will get a vivid explanation of the algorithm for working on your product while you are still searching for product/market fit.

- This approach works well in the early stages of product development, when other approaches are difficult to apply.

Cons:

- The 40% benchmark can be misleading. This value was obtained empirically based on Sean’s analysis of hundreds of startups. But the ratio will probably differ across B2B and B2C products or services from different categories. I would recommend focusing more on the dynamics of the metric and on the qualitative information received from customers when using this approach.

- If there are inconsistencies through different stages of your research, you might get false results. To avoid this, make sure that the method of recruiting users and the method of conducting research stays the same for different versions. This will allow you to compare the metric in different versions and track its dynamics.

I would recommend using the described approach simply as one of the signals (a leading indicator, if you please) to determine whether your product is ready for scaling. Please avoid making this approach the only one in your decision-making.

Product/market fit based on DAU/MAU

This approach was proposed by Andrew Chen. He later published an article that analyzed the tradeoffs of this approach.

«DAU/MAU is a popular metric for user engagement – it’s the ratio of your daily active users over your monthly active users, expressed as a percentage. Usually apps over 20% are said to be good, and 50%+ is world class.

How did this metric come into use? DAU/MAU has been a popular metric because of Facebook, which popularized the metric. As a result, as they began to talk about it, other consumer apps came to often be judged by the same KPIs.”

Pros:

- The method of calculating the DAU/MAU metric is clearly defined and well understood.

- The presence of a numerical expression of the approach allows you to segment the audience and highlight those who find maximum value in the product.

Cons:

- You can easily change the DAU/MAU metric without making modifications to the product itself. For example, when you scale up your paid acquisition, the metric drops. Stop paid acquisition, and the DAU/MAU will start to grow.

- The target value for this metric should differ across different product categories. For instance, it makes no sense to expect the same DAU/MAU ratio from WhatsApp and Uber. At the same time, both products have definitely proven their worth.

Product/market fit based on long-term retention

The next approach is presented by Alex Shultz, VP of Growth at Facebook. Facebook uses this approach actively. However, I practically didn’t meet anyone outside the blue social media giant following it.

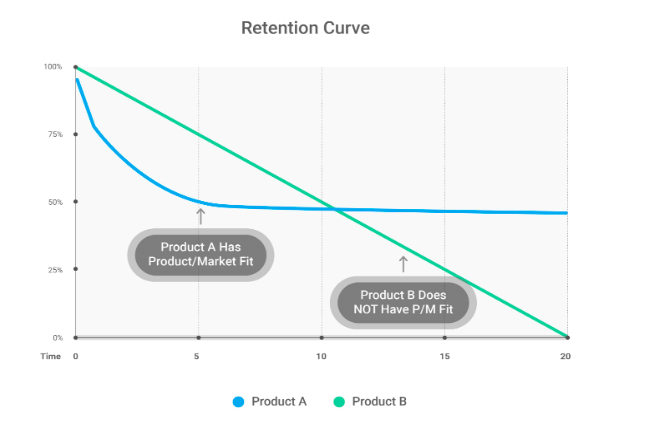

«Look at this curve, ‘percent monthly active’ versus ‘number of days from acquisition’, if you end up with a retention curve that is asymptotic to a line parallel to the X-axis, you have a viable business and you have product market fit for some subset of market.»

(I strongly recommend watching this lecture)

In a nutshell, this approach means that if a product can turn part of its new users into the regular audience, then that part of the market finds the product valuable and is ready to keep using it on a regular basis.

A more pragmatic reason to aim for retention to plateau is that it is a necessary component for a controlled and predictable growth. If a part of new users turns into a regular audience and stays with you for a long time, then you have a foundation for growth.

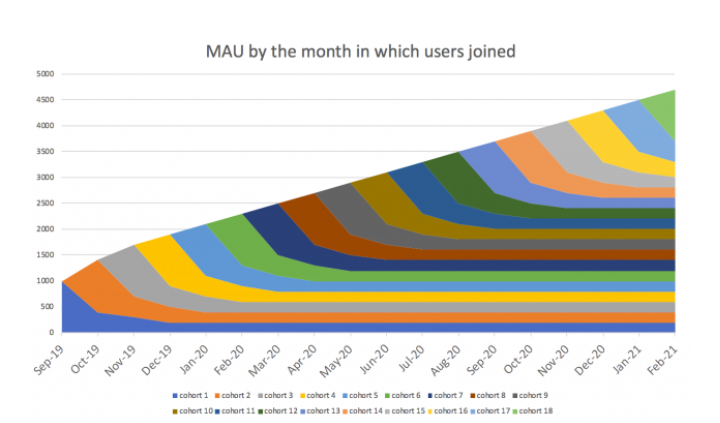

Segmenting the active audience by the month users joined the product will give you a chart that looks like the following. Each cohort adds a new layer to a future stable MAU.

If the new users leave sooner or later, then at some point you will reach the growth limit. At an early stage, your product might grow without a plateauing retention, but at some point, your new users won’t be able to compensate for the volume of existing users leaving the product.

An important question is, what level of a retention plateau should be considered as suitable? The answer depends on the type of product, but the performance of market leaders can be a good benchmark to aim for.

This approach to measuring product/market fit is one of my favorites. There are no obvious flaws, and there are several advantages:

- It allows you to segment the audience and the market, highlighting the segments that find maximum value in the product. This is especially useful during the stage before reaching product/market fit. Here, I’d like to once again recommend the article from Superhuman’s CEO. If you combine his method with this approach of measuring product/market fit, you will have a very powerful tool.

- This approach is very clear and blunt.

- Retention is determined by the product and the new users who joined the product (market segment). Therefore, this approach is perfect for describing the product/market fit.

- It allows you to look at the product within the prospects of its future growth.

This approach also works well with the one described by Sean Ellis, which is able to provide a more qualitative product information and is crucial for selecting a vector in the early stages of product development.

Summing up

Achieving product/market fit means that you have found a market segment where customers choose your product to solve their problems. This article gives you several ways to determine and measure how far are you from achieving this goal.

It is important to understand that product/market fit is just an intermediate point on the road to building a successful business around your product. After reaching product/market fit, you will have to look for distribution channels to reach the market segment where the product generates maximum value. Once you do this you will have to work on the economy within the distribution channels that you’ve found. But that’s better left for another post. Stay tuned!