One of the concepts that is crucial to product work is compound interest and exponential growth. This is a topic that has been adopted from other fields of natural and social sciences into product management. It is crucial in tracking, measuring, and forecasting product growth loops. Understanding compound interest and exponential growth can help you identify growth opportunities, make correct decisions and avoid the pitfalls of product growth.

In this article, we will discuss the basics of compound interest and exponential growth and how it applies to product management.

→ Test your product management and data skills with this free Growth Skills Assessment Test.

→ Learn data-driven product management in Simulator by GoPractice.

→ Learn growth and realize the maximum potential of your product in Product Growth Simulator.

→ Learn to apply generative AI to create products and automate processes in Generative AI for Product Managers – Mini Simulator.

→ Learn AI/ML through practice by completing four projects around the most common AI problems in AI/ML Simulator for Product Managers.

Understanding compound interest and exponential growth

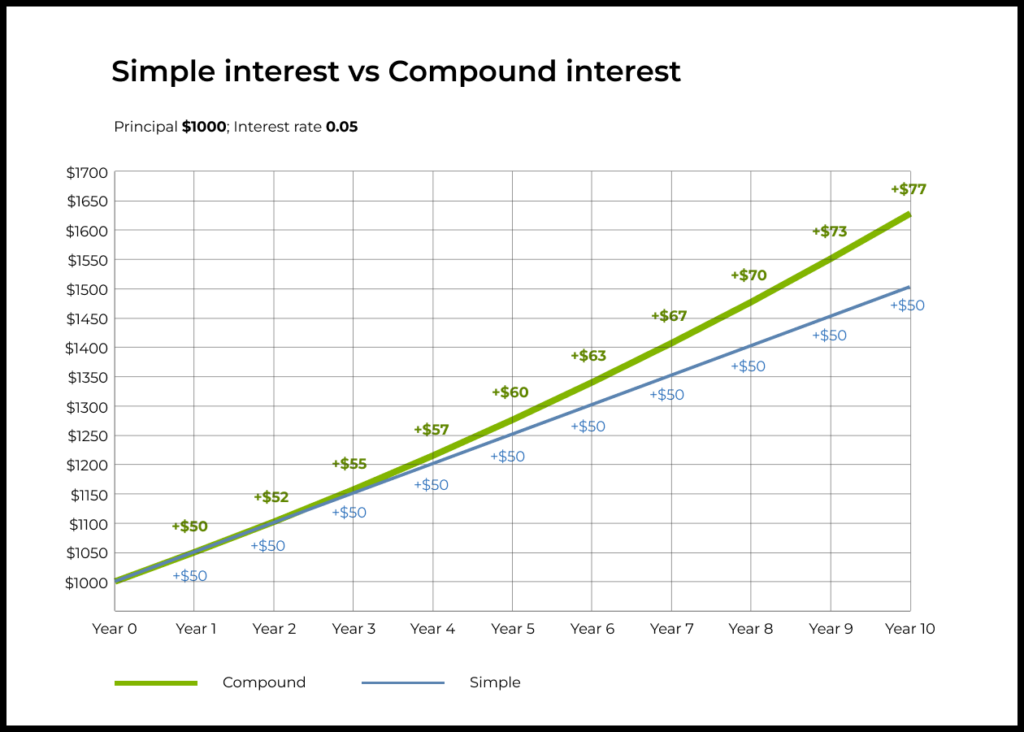

Consider a merchant who owns $1,000 in cash. A bank approaches her and suggests holding her savings in exchange for 5% in interest per year. The merchant accepts the offer and deposits her money at the bank. At the end of the year, the bank rewards her with 1,000 * 5% = $50. She now has $1,050.

If she continues to keep her money at the bank for another year, then her reward will be 1,050 * 5% = $52.50 and she will have $1,102.50. In the next few years, the accrued interest will continue to increase to $55.13, $57.88, $60.78, and so on. The following graphs show the merchants accrued interest and total money over the years and how the accrued interest changes over time.

The above scenario is an example of “compound interest.” Compounding is the process in which the value of an asset gradually increases at an accelerating pace. Compounding involves a principal (in our example, it is the initial $1,000 deposit), an accrued interest (in our example, it is the 5% annual reward), and a frequency (in our example, it is once per year). The interest is added to the principal as well as the interest already paid, which is why it increases over time.

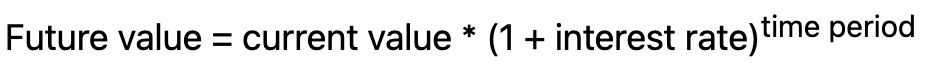

The simple formula for calculating compound interest is as follows:

For example, to calculate the value of the $1,000 deposit with a 5% interest rate in five years:

Compound growth in product management

The key idea behind compounding growth is a loop that repeats and reinforces itself by feeding back its output into the input of its next cycle. This is a theme that you will see in different areas of product management.

Here is an example:

Consider MailAnywhere, a company that provides a newsletter service that its clients use to send mass emails to their users. At the end of each email it sends, MailAnywhere adds a message in which it invites users to click on a link and create their own account on the newsletter service.

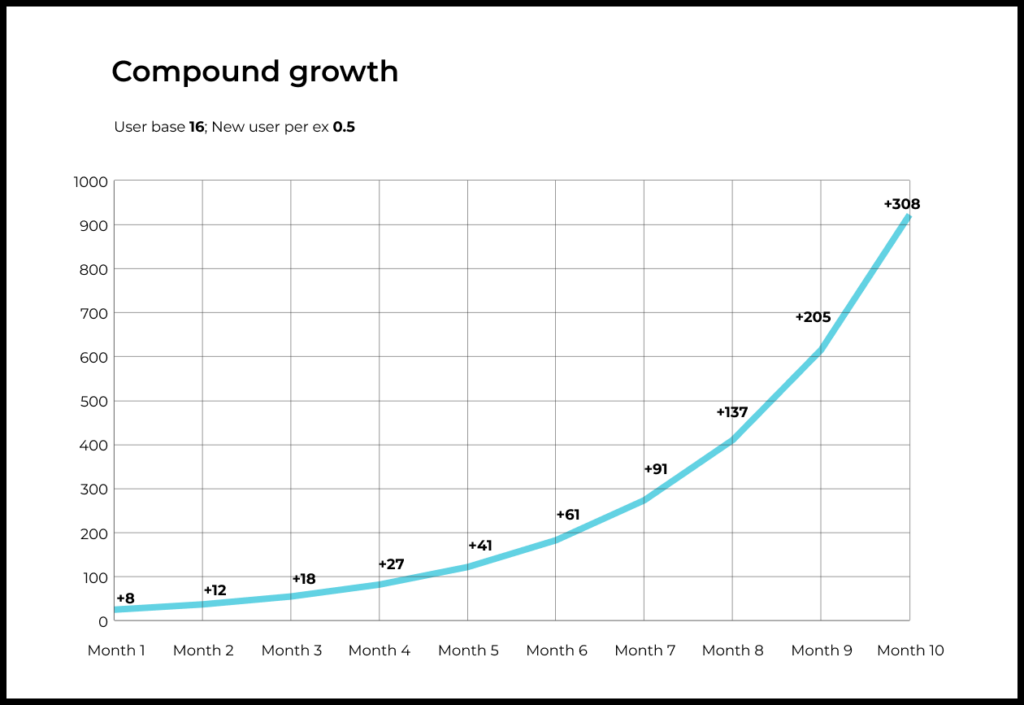

Say that on average, every user sends 100 emails per month, and out of every 200 emails sent, one new user signs up (0.5% conversion rate). MailAnywhere has 16 users in January. Here is how new users join the company:

- In January, 1,600 emails (16 users x 100 emails) are sent through the newsletter service

- As a result of the emails, 8 new users join the newsletter service (1,600 * 0.5%)

- In February, the newsletter service has 24 users and therefore sends 2,400 emails (24 users * 100 emails)

- The new emails bring in 12 new users (2,400 * 0.5%)

- And the loop repeats itself

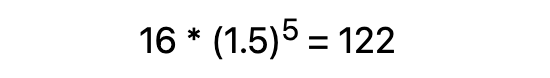

If we look at this example, we can say that each user brings 0.5 new users per month. Now, by plugging its elements into the compound interest formula, we get the following equation:

So, if we want to know how many users we will have after five months, we get the following:

Growth loops

The above example is a pattern of compound growth that you’ll regularly see in product work. It is called a “growth loop” and it is one of the fundamental concepts in product growth. The growth loop has the following key characteristics:

- Users acquired in one cycle of the loop participate in acquiring the next batch of users

- The loop can repeat itself multiple times

Discovering and optimizing growth loops is one of the most important parts of working on product growth. However, it is worth noting that some kinds of growth mechanisms do not qualify as growth loops. Consider the following example:

MailAnywhere enters a sponsorship deal with a YouTube influencer. The influencer does a short advertisement for MailAnywhere at the beginning of her next video. As a result of the promo, 100 new users sign up for the service.

While the above example is an effective method to grow your audience, in its current state, it is not considered a growth loop because there is no mechanism to restart the loop. However, if the revenue from the new users would be enough to allow MailAnywhere to enter more YouTube promotion deals, then it could be considered a kind of growth loop.

***

This was a brief intro to compound and exponential growth in product management. There are more nuances to how these concepts are used in product management. You can link growth loops together, amplify them with boosting mechanisms, and do a lot more, while also using the laws of compounding to predict how they can affect your business.

If you’re eager to expand your knowledge on this matter, we invite you to enroll in our Product Growth Simulator.