After my recent essay “Slack vs Teams vs Workplace: The intriguing dynamics of the work messenger market,” I didn’t plan to revisit the competition between Slack and Microsoft Teams just yet. Despite the rapid development of the work communication market, it is still a B2B market that is changing relatively slowly.

However, something extraordinary has happened: We are in the midst of one of the greatest “experiments” of our time, and a great part of the world has switched to remote work due to the COVID-19 pandemic. The outbreak has greatly sped up the development of remote work tools. This situation has propelled us several years ahead in time, much faster than it was destined to happen, allowing us to look into the future of the market today.

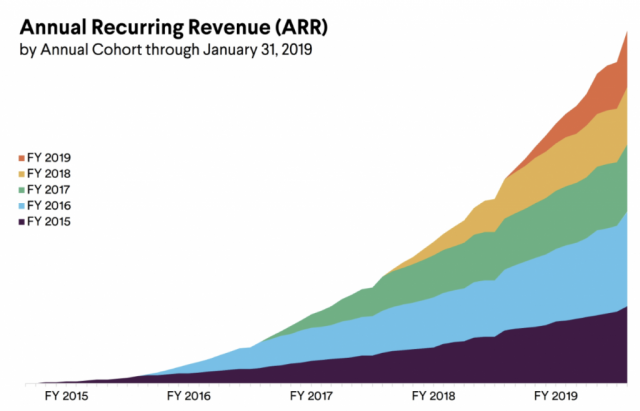

Another reason to take a closer look at Slack vs Teams is that recently, a lot of new data has surfaced about Slack. Even before the coronavirus outbreak, several large companies decided to adopt Slack as the communication tool for all their employees, including IBM with its 350,000-strong workforce and Uber, which has more than 38,000 employees. The number of paid Slack customers has grown by more than 7,000 over the past one and a half months, surpassing the growth in the entire previous quarter. This week, Slack CEO Stewart Butterfield shared the sequence of the recent events in a series of posts on Twitter, all of them conveying a clear message: Slack is growing very fast.

All of the above made me doubt the assumptions I’ve made in my past essays, in which I didn’t put too much faith in Slack’s chances of winning the race against Microsoft Teams. In light of the new data, I decided to take another look at the market and figure out what was going on.

And here’s what I realized: Slack is a great business, but it still stands no chance against Microsoft Teams in dominating the messenger market. The recent weeks have further confirmed this assumption.

→ Test your product management and data skills with this free Growth Skills Assessment Test.

→ Learn data-driven product management in Simulator by GoPractice.

→ Learn growth and realize the maximum potential of your product in Product Growth Simulator.

→ Learn to apply generative AI to create products and automate processes in Generative AI for Product Managers – Mini Simulator.

→ Learn AI/ML through practice by completing four projects around the most common AI problems in AI/ML Simulator for Product Managers.

Slack is growing fast, but is still losing its market share

There’s no doubt that Slack is growing really fast right now.

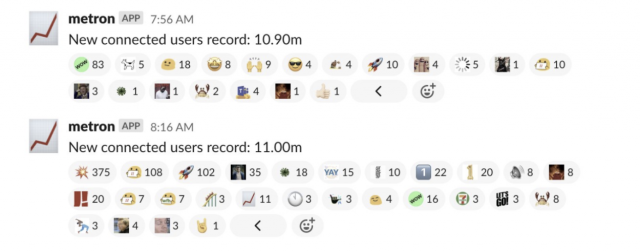

Slack has added more paid customers in one and a half months (7,000) than it did in the previous quarter (5,000). The Slack team struck a number of major deals (IBM with over 350,000 employees, and Uber with 38,000 employees). Every hour, Slack is breaking the records for simultaneously connected users.

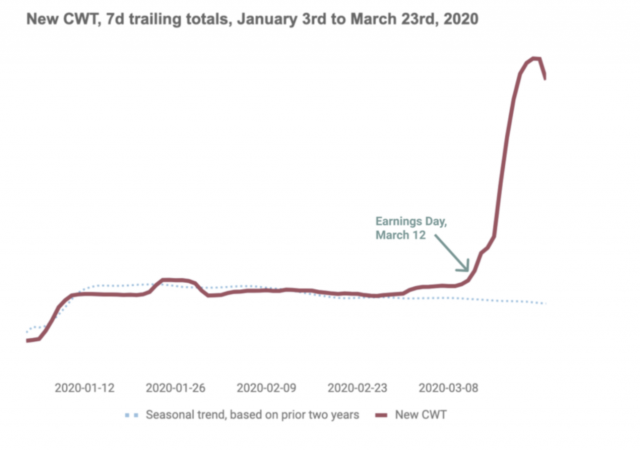

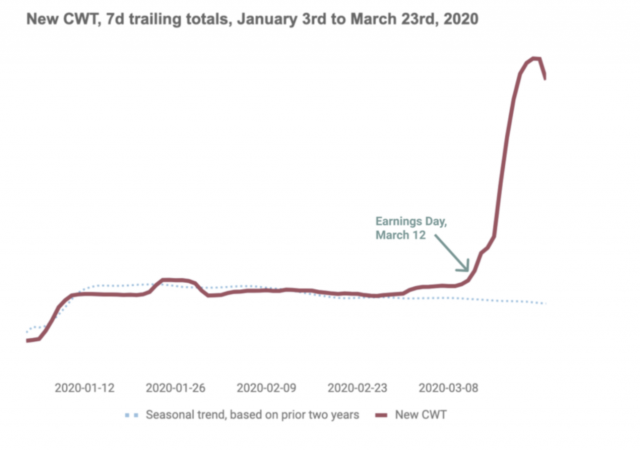

Below you can find a graph showing the number of new teams registering in Slack as was shared Butterfield on Twitter.

But looking at Slack alone won’t help us to understand what is really happening. Instead, we need to look at the bigger picture and compare Slack to other players in the market.

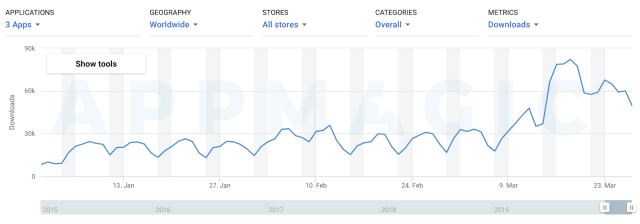

In a previous essay, we discussed that a good proxy of the new users’ dynamics of Slack, Teams and Workplace is their app download figures. Feel free to read more about it here.

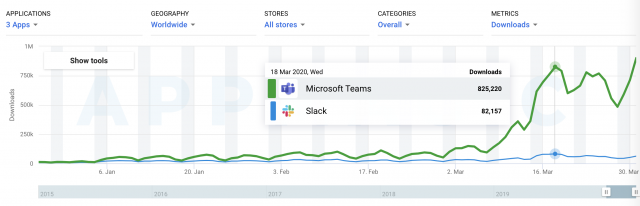

The graph below shows Slack’s app downloads over the past three months based on Appmagic data. Compared to February, Slack’s downloads have increased almost threefold. To be clear, the figures are very impressive (it is a very rapid growth for a B2B product). The growth dynamics also correspond with what we see on the graph above, which partly confirms the validity of the valuation method.

Now comes the fun part. The chart below compares the dynamics of app downloads for Slack and Microsoft Teams. Microsoft Teams has experienced a significantly quicker growth than Slack has. While Slack was enjoying its threefold growth, Microsoft was registering a 10x spike in comparison to its previous quarter. And let’s not forget that we are talking about growth from a higher ground than Slack’s.

If you look at the graph below, then Slack’s line looks nearly flat in comparison to its Microsoft rival. The influx of new users to Teams now exceeds Slack’s figures by more than 10 times.

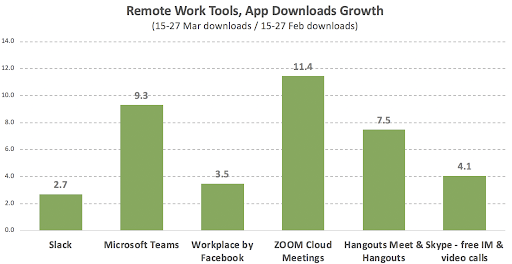

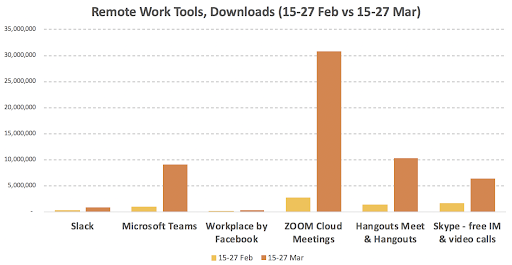

In order to grasp the more general context of the situation, let’s look at the increase in the number of mobile app downloads of leading services used for remote teamwork.

Slack’s growth rate (2.7x) is the lowest among the most popular remote work tools. Zoom (11.4x), Teams (9.3x), and Hangouts (7.5x) are among the leaders here.

Hangouts’ numbers are likely to be a bit overestimated since Google is now migrating its users from Hangouts to Hangouts Meet and Hangouts Chat.

It is important to note this is not an effect caused by starting low. For example, Zoom has grown 8.5 times bigger than Slack. Teams, has grown from a base that was three times bigger than Slack’s.

How the growth models of Slack and Microsoft Teams work

I took a look at this issue in detail in one of my previous essays. Below is a brief description of the growth models of the two products.

Slack built an effective growth machine by using their bottom-up model: Using word-of-mouth, the free version of Slack finds a foothold into teams and then starts to grow inside companies (sometimes organically, and sometimes with the help of Slack’s sales team, and sometimes in both ways simultaneously).

In contrast, Teams prefers a top-down growth model. Microsoft has a unique distribution channel: Microsoft products for business (Office 365) are used by over 100M users from various industries across the world. Microsoft also has close relations with CIOs and heads of IT departments of large- and medium-sized companies, who can easily preinstall new services on their employees’ computers using special software.

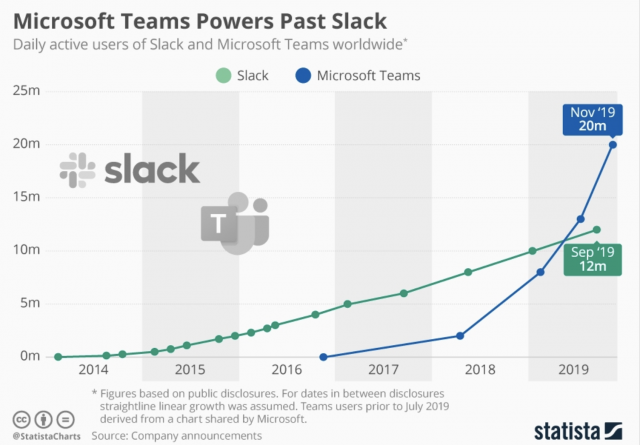

By leveraging these distribution channels, and also by taking advantage of the transition of Skype for Business users to the new service, Microsoft was able to show phenomenal growth for Microsoft Teams over the past two years. You can read more about Teams’ growth model here.

According to the latest data, Teams’ DAU exceeded 44M users, and in recent weeks it has grown by 12M, which is equal to Slack’s entire DAU in September 2019.

Why is Microsoft Teams growing much quicker than Slack during the shift to remote work?

To answer this question, let’s look at how exactly the mass transition to remote work tools has affected the growth of Slack and Microsoft Teams.

The first driver of growth is the increase in online activities of the current users. Due to the current circumstance and the impossibility of in-person meetings, users are forced to perform a greater number of tasks using messenger apps.

I suppose that in this case the Teams’ growth was greater because in the IT industry, where Slack has a strong position, companies had already moved a significant part of their communication online before the recent events. The same can’t be said for non-IT organizations, where Teams is having a bigger success.

The second growth driver was a sharp increase in the number of new users within organizations that are already using Teams or Slack (i.e. the growth of old cohorts). To make remote work effective with the help of a corporate messenger, one needs to make sure the whole team or company is using it.

Transitioning to remote work has sped up the process of launching Slack and Teams to all users in organizations where one of these messengers is already being used. I believe that in this case, Slack’s growth was stronger than Teams’ due to bottom-up and top-down growth models strategies’ aspects. With a bottom-up strategy, an average company’s penetration is usually lower, which means that there is a bigger growth potential.

The third growth driver is somewhat similar to the second one, but it is associated with the return of organizations that had at some point tried the product but stopped using it. For example, in Italy, Slack observed a 120% increase in the number of new “retaining teams.” In Japan and Korea the numbers are 34% and 33%. Most likely, in this case the growth of the two products is comparable.

The fourth growth driver is the new users from new companies that haven’t used the service before. From my point of view, this is exactly where Teams has secured a significant advantage over Slack.

The massive transition to remote work has amplified each messenger product’s acquisition channels for new organizations.

This means that a lot of new teams and small companies from the SMB (small and medium-sized business) segment are now coming to Slack. This proves to be correct if we look at the number of new teams Slack’s CEO presented.

A large influx of new teams is good news for Slack, but this is only the beginning of their long sale cycle. It may take these teams years to adopt Slack as the default communication tool in the whole company.

Teams has a completely different customer acquisition model. Their main growth channel is built around direct access to its Office 365 customers—the Teams product is a free part of it. Due to the recent events, many companies are preparing to make the transition to a remote mode, and Teams happens to be the most accessible option for them.

Unlike Slack’s complicated way to enter the company, Teams can be easily installed on the computers of all company employees in just a few clicks by IT staff who can pre-install and update Microsoft products on devices.

Sale cycle length, free vs paid, no differentiations on a product between the two products

Unlike Slack, which is growing through the bottom-up model, Teams’ growth cycle in a particular company (from the start of using Teams inside the company to launching it for all of the company’s employees) is much shorter. Also take note that the average size of organizations that use Teams is significantly larger than Slack’s.

The price has to do a lot with it when it comes to choosing between the two work messengers. Teams is a free addition to Office 365 that most companies are already paying for, while Slack is a quite expensive standalone product. Price becomes an extremely important factor when choosing between the two similar products in the face of an impending recession and an economic crisis (these two are practically indistinguishable for people outside the IT world).

You might think of IBM and Uber’s decision to choose Slack as a counterargument to my statement about the price and similarity of the two products. First, these are IT companies, where employees—especially developers—make their voices heard, something that doesn’t happen very often in other industries. Second, we are talking about companies where people have started using Slack many years ago, and the product has managed to organically penetrate in a large number of teams. For IBM and Uber, migrating to a new messenger would be more expensive than offering Slack to all employees.

Slack’s key problem within the context of their future growth is the following: Microsoft doesn’t plan to give them a few years’ head start in other large companies. When choosing Slack vs Teams under equal conditions outside the IT industry, Teams looks much more preferable.

Closing thoughts

Slack is growing rapidly indeed, but slower than its main competitor. This means it continues to lose its market share in the corporate communication tool market. Microsoft Teams has a stronger strategic position and continues to take over the enterprise segment, consolidating a leadership position for itself.

Another interesting question about a slightly more distant future was asked by Stewart Butterfield himself:

In your opinion, which customer base is more resistant to the economic turbulence that looms on the horizon?