This is part of a series of articles on the basics of product management and building products that people need.

In this essay, you’ll learn to determine how much better your product needs to be than the available alternatives to achieve product/market fit.

→ Test your product management and data skills with this free Growth Skills Assessment Test.

→ Learn data-driven product management in Simulator by GoPractice.

→ Learn growth and realize the maximum potential of your product in Product Growth Simulator.

→ Learn to apply generative AI to create products and automate processes in Generative AI for Product Managers – Mini Simulator.

→ Learn AI/ML through practice by completing four projects around the most common AI problems in AI/ML Simulator for Product Managers.

↓ All posts of the series:

→ Addressing user pain points vs solving user problems better.

→ Product manager skills: evolution of a PM role and its transformation.

→ Product metrics, growth metrics, and added value metrics.

→ Customer retention levers: task frequency and added value.

→ How to measure the added value of a product.

→ Should a product be 10 times better to achieve product/market fit?

→ Product/market fit can be weak or strong and can change over time.

→ Two types of product work: creating value and delivering value.

→ What is the difference between growth product manager, marketing manager, and core PM.

“To achieve product/market fit, your product must be 10 times better than any existing alternatives.”

This is something you hear often in discussions about creating new products. And although it sets the right direction of thought, this thesis is an oversimiplification.

The origins of the 10x improvement thesis

In The Hard Thing About Hard Things, acclaimed investor and entrepreneur Ben Horowitz writes:

“The primary thing that any technology startup must do is build a product that’s at least ten times better at doing something than the current prevailing way of doing that thing. Two or three times better will not be good enough to get people to switch to the new thing fast enough or in large enough volume to matter.”

Prior to that, Peter Thiel popularized the concept in his book Zero to One:

“As a good rule of thumb, proprietary technology must be at least 10 times better than its closest substitute in some important dimension to lead to a real monopolistic advantage. Anything less than an order of magnitude better will probably be perceived as a marginal improvement and will be hard to sell, especially in an already crowded market.”

It is easy to see that Thiel’s statement differs from the thesis about the need to improve 10 times to achieve product/market fit.

- Thiel is talking about a 10x improvement in some important dimension, not a 10x improvement in performance on the whole problem. Today’s technology has already gone far enough to expect a tenfold improvement from each new generation of products.

- Thiel is talking about the improvement necessary to achieve monopolistic advantage in a competitive market. This is a much more aggressive goal than building a marketable product around which to build a business.

In this essay, we will examine the improvement that your product must have over alternatives to achieve product/market fit. Achieving product/market fit is a more modest goal than creating a monopoly in a huge competitive market, but it is a necessary first step for any product.

The added value required for switching varies for different tasks and contexts

Getting from London to Zurich

John wants to get from London to Zurich. To solve his problem, he goes to a metasearch engine for airline tickets, where he configures his desired date of travel and other important factors.

John has a limited budget, so the key factor when choosing a ticket is the price. Assuming all other factors are comparable, a 10% difference in price would be enough to determine John’s choice.

Therefore, within the context of the task “getting from London to Zurich” for the segment of price-sensitive users, even a small difference in ticket prices will be enough to win a client (given that other factors are equal). In this case, to achieve product/market fit, you need to be just a bit better, that is, create relatively little added value.

Managing a sales team

Company X manages a sales team of 30 people with a CRM solution that costs $3,000 per month.

One day, Company X receives an offer from a competing CRM solution provider. This new product is comparable to Company X’s current solution in terms of features and efficiency, but is offered at $2,000 per month, two-thirds of the price Company X is paying for its current CRM solution.

A one-and-half times price reduction provides a significant added value. But in this case, it is not enough to motivate Company X to make the switch. This is because pricing is only one of the multiple variables that constitute the cost of a CRM system.

- All team members are trained to use the current system, and the company’s workflows are built around it. The transition to the new system will require retraining employees and creating new workflows. This will decrease efficiency during the transition period and incur additional costs.

- The current CRM system stores a huge amount of data that the sales team uses every day. Porting the data to a new system will require the costly help of developers and database experts.

- The current CRM system is integrated with other services Company X uses. The transition to a new system will require new integration efforts, which again, are costly.

For Company X to switch to a new CRM system, it would take a lot more value added than a 1.5x savings on subscription costs.

Determining the added value needed for a switch

We live in a world where most people’s needs have already been met. Your potential customers are already solving important tasks in their lives in one way or another.

If you want to create a new in-demand product, then you need to offer users a more efficient solution.

- For any market segment, if your solution is less efficient than what users are already using, then your product won’t achieve product/market fit in that segment. Users will have no reason to switch to your product.

- Even if your product is more efficient, product/market fit is not guaranteed. Different tasks will require different levels of added value in order to convince the user to switch.

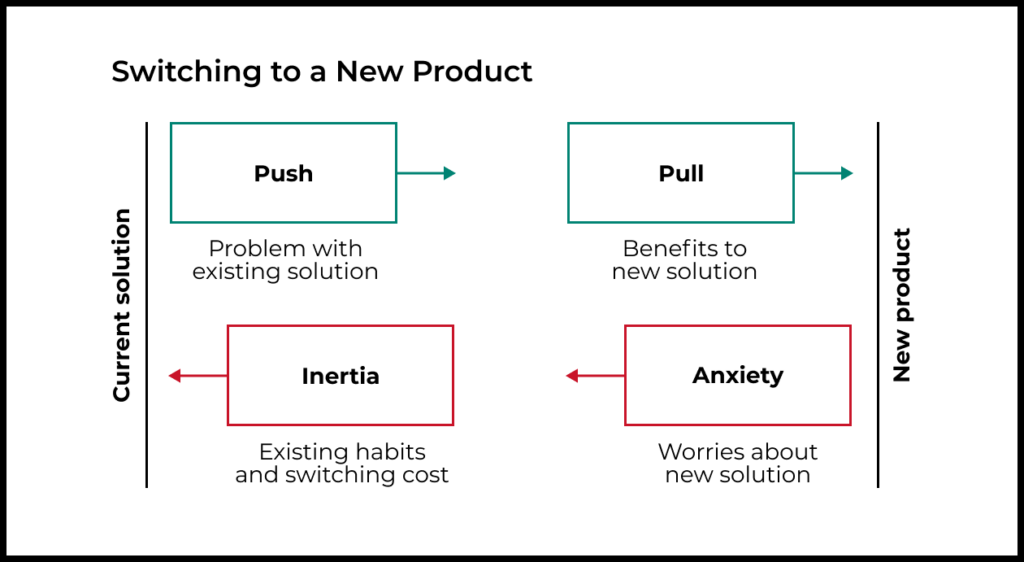

As we discussed in the first essay of the series, several factors can influence the decision to switch from an old solution to a new one:

- Issues with the current product: The user is unsatisfied with the current solution and is looking for a more efficient solution.

- Potential benefits from the new solution: The user believes that the new product is more effective and will make her life better.

- Doubts about the new product: The user is not sure whether the new product will deliver on its promises.

- Switching cost: The effort required to move from an old product to a new one.

The combination of these factors determines the required added value, i.e., how much better the new solution must be for a person to choose it over the existing one.

In a nutshell, the added value should be greater than the switching cost.

Examples of factors that determine the added value required for switching

Managing a sales team

When considering a new CRM system, a better pricing plan will pull sales teams toward switching to a new solution.

But at the same time, the huge cost of switching pulls in the opposite direction. This includes the costs of retraining employees, restructuring workflows, the drawdown in sales efficiency, and re-implementing integrations with existing software.

A sales team will switch to a new product only if the added value outweighs the costs.

Getting from London to Zurich

In the London-to-Zurich example, for John, the experience of all the suggested flights is comparable. Therefore, even a small difference in ticket price is enough to determine his choice.

But if John were a regular flyer and had a frequent flyer membership at an airline company that provided substantial benefits, then the added value needed to switch to an alternative would have to be greater.

Buying books

Amazon started out by selling books online. Jeff Bezos explained that he chose books first because in this category, it was easier to create maximum added value in comparison to brick-and-mortar retailers.

“I picked books because books are super unusual in one respect: there are more items in the book category than in any other category. There are three million different books in print around the world at any given time. The biggest bookstores had only 150,000 titles. So the founding idea of Amazon was to build a universal selection of books in print.”

—Jeff Bezos

This decision enable Amazon to reach tremendous added value in comparison to bookstores and allowed the product to achieve a strong product/market fit from the very beginning:

- The largest offline bookstore could hold up to 100,000 books. Amazon gave customers access to 1 million books.

- Finding a book in an offline store is much more difficult than finding it on Amazon.

- Reviews from readers made Amazon’s book selection even more efficient. The offline store did not have the equivalent.

- The book Invent and Wander recounts how Amazon tracked the prices of the most popular books at competitors and ensured that they were lower.

In many contexts, Amazon was more efficient in solving the problem of buying books, which allowed them to achieve product/market fit and start taking the market from bookstores.

Added value is subjective and depends on the context

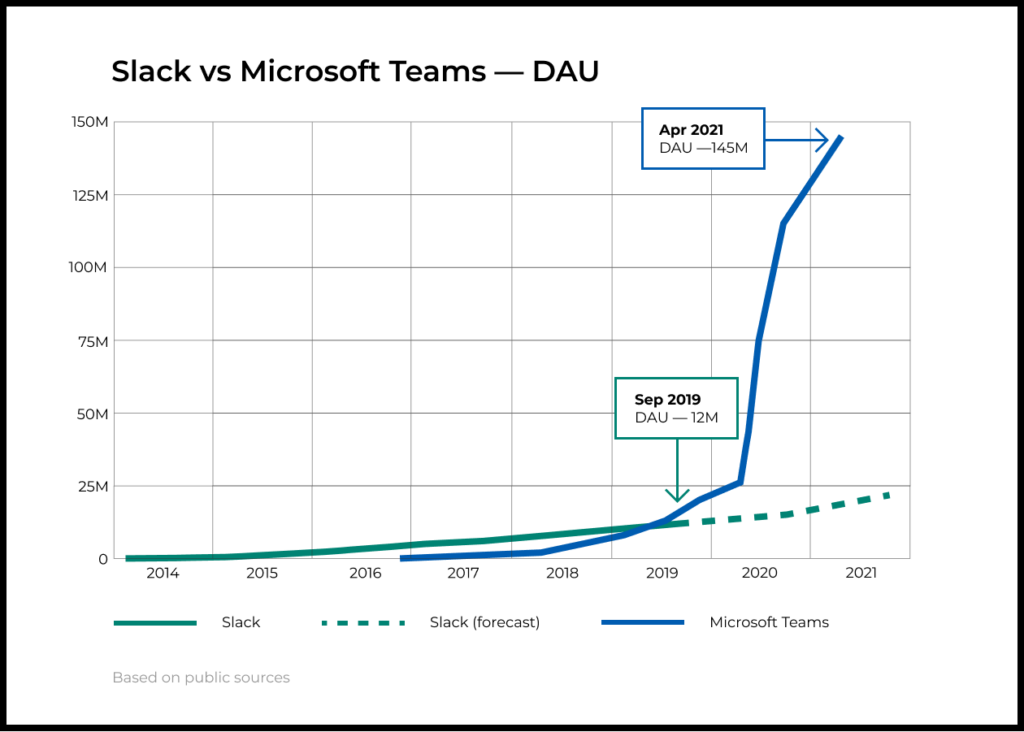

The added value of Slack for a company that only uses email for communication is very high. But for a company that has completely switched to Microsoft Teams, Slack might have zero added value.

That is why the rapid growth of Teams through Microsoft’s own distribution and sales channels is such a big problem for Slack. In the enterprise sector, the Slack team will have a very hard time attracting companies that are already using Teams because its product does not add value.

When the first mobile messengers appeared, their added value in comparison to SMS was significantly higher in Brazil than in the US. This is because in Brazil, telecom operators charged users for every SMS. In the US, most tariffs included an unlimited number of SMS for a fixed price per month.

That is why the growth of mobile messengers in the US market was slower than in Latin America. The added value of messengers was significantly higher for users in Latin America.

These examples illustrate that the same product can have different added value depending on the context.

Added value is influenced by the following factors:

- The current product used to solve the problem: The added value of Slack is small for a company that uses Teams, but is big for a company that relies mostly on email.

- Information about alternatives and their effectiveness: Often users don’t have all the information about alternatives and their effectiveness when they make a decision about a new product. This is especially true in B2C. In B2B, decisions are more often rational, made on the basis of a comparison of alternatives.

- User context: There are many factors that can make a particular solution more valuable to users. We discussed the subjectivity of added value in detail in a previous article.

Added value in practice

The added value of the same product can vary significantly across different use cases and user segments. As a result, a product may achieve product/market fit in certain segments but not in others.

This directly affects the approach to the development and growth of products.

Focus on segments with maximum product/market fit

The higher the added value of the product and the lower the cost of switching, the more likely it is to convince users of a segment to switch to the new solution. Accordingly, the growth rate in that segment will be higher. Focusing marketing and product resources on these segments will maximize results.

The founder of Superhuman details the practical application of this insight in this essay. He explains how they began to measure the strength of product/market fit and then built a product process around improving this metric.

Better efficiency and added value leads to increased product/market fit and expansion of the target market

As the product develops and improves, its effectiveness will increase. This will have two effects:

- Growth acceleration in segments where product/market fit was initially achieved: Greater added value will result in faster switching from the old solution to the new one.

- The emergence of new market segments where added value will outweigh the cost of switching: This will help to achieve product/market fit in these segments and expand the product’s target market.

This brings us back to the thesis that increasing the efficiency and added value of a product is one of the main drivers of its growth.

Product/market fit and added value

In this essay, we discussed the key factors that determine the added value necessary to achieve product/market fit. And although we did not get an exact improvement factor, we realized that the added value should outweigh the cost of switching from an old product to a new one:

- For a given user segment, if your product doesn’t create added value in comparison to their current solution, then you won’t achieve product/market fit. Users won’t have a compelling reason to switch.

- If your product creates added value, then there is a chance to reach product/market fit. But high switching costs or user doubts about the effectiveness of the new product may well outweigh the potential benefits and prevent users from making the switch.

- To achieve product/market fit, the added value of a new product must be large enough to justify the investment required to change habits. As a result, the amount of added value required to achieve product/market fit will vary for different tasks and habits.

We learned about the link between added value and product/market fit. This brings us to another important idea: Product/market fit is not a binary function (you either have it or you don’t). Product/market fit is a spectrum. It can be strong or weak, and its strength can change over time.