This is part of a series of essays on the basics of product management and building products that people need.

In this essay, you will learn about the variables that determine the strength of product/market fit. You will also learn why product/market fit can change over time and what this means for your product. We will look at BlackBerry’s history to better understand these dynamics.

For most teams working on a new product, product/market fit is the primary goal. This is a cherished milestone, after which the team expects rapid growth.

This mindset assumes that product/market fit is a binary variable. Your product either achieved product/market fit or it did not.

In reality, product/market fit is a spectrum. It can range between not being present to being weak, mild, or strong. Moreover, its strength can change over time, which affects the performance and growth of the product.

→ Test your product management and data skills with this free Growth Skills Assessment Test.

→ Learn data-driven product management in Simulator by GoPractice.

→ Learn growth and realize the maximum potential of your product in Product Growth Simulator.

→ Learn to apply generative AI to create products and automate processes in Generative AI for Product Managers – Mini Simulator.

→ Learn AI/ML through practice by completing four projects around the most common AI problems in AI/ML Simulator for Product Managers.

↓ All posts of the series:

→ Addressing user pain points vs solving user problems better.

→ Product manager skills: evolution of a PM role and its transformation.

→ Product metrics, growth metrics, and added value metrics.

→ Customer retention levers: task frequency and added value.

→ How to measure the added value of a product.

→ Should a product be 10 times better to achieve product/market fit?

→ Product/market fit can be weak or strong and can change over time.

→ Two types of product work: creating value and delivering value.

→ What is the difference between growth product manager, marketing manager, and core PM.

What is the strength of product/market fit?

The presence of product/market fit indicates that there is a segment of users who choose your product among the available solutions to their problem.

For example, many people use the Telegram messenger for work communications. This means that for some tasks and some users, Telegram is the most effective way to solve the problem among the available solutions. We can say that Telegram has achieved product/market fit.

Now let’s figure out what characterizes the strength of product/market fit. Let’s say that during the week, you have N situations where you use instant messengers or other products to discuss work issues. In 50% of cases you use Slack, in 30% Telegram, and 20% email.

In this case, Slack will have the strongest product/market fit, since you choose it in the largest proportion of cases when the relevant task arises. Telegram will have weaker product/market fit within the task of work communication—it turns out to be the most effective solution only in 30% of cases.

The strength of product/market fit characterizes in what proportion of cases users choose a specific product instead of alternatives solutions. If a user segment uses a product in 100% of situations, then the product has reached the maximum product/market fit strength. If users choose it in only 10% of cases, then it means that in 90% of cases, alternative solutions were more effective.

Achieving product/market fit is just the first step

Achieving product/market fit for a new product is just the first step toward growth and scaling. You have created a fairly effective solution to the problem for a segment of users who now choose your product instead of available alternatives.

Now, your task is to strengthen and/or expand the product/market fit. You can achieve this by increasing the efficiency of solving the problem (increasing the strength of product/market fit), as well as optimizing the product for the needs of adjacent user segments (expanding product/market fit).

Let’s go back to the Telegram example.

For me, Telegram initially achieved product/market fit for the usecase of communicating with my wife. As the number of friends and acquaintances I had in the messenger grew and its functionality expanded, I began to communicate with more and more people there. The strength of Telegram’s product/market fit grew for me.

Gradually, Telegram became more and more efficient among the alternatives I knew, which increased the strength of its product/market fit. At some point, Telegram became my main messenger, taking most of the “work” from Facebook Messenger and WhatsApp.

As we discussed, to increase product/market fit strength, you must increase the added value relative to alternatives and reduce switching costs. Increasing the strength of product/market fit, in turn, affects product growth on several levels at once:

- Improved retention (if product solves a regular problem): Users increasingly choose your product when a relevant task arises.

- Improved monetization: Increased usage means users are more likely to encounter elements of the monetization model, and also better convert to a purchase, as they see more value.

- Improved user acquisition: Satisfied users spread the word about your product, and more effective monetization allows you to increase the effectiveness of paid acquisition channels.

The history of BlackBerry through the lens of product/market fit strength

The history of BlackBerry is a great example of how the strength of product/market fit can change over time and directly affect the company’s growth.

Let’s look at the rise and fall of BlackBerry through the changes to its product/market fit and its added value in comparison to ther alternatives.

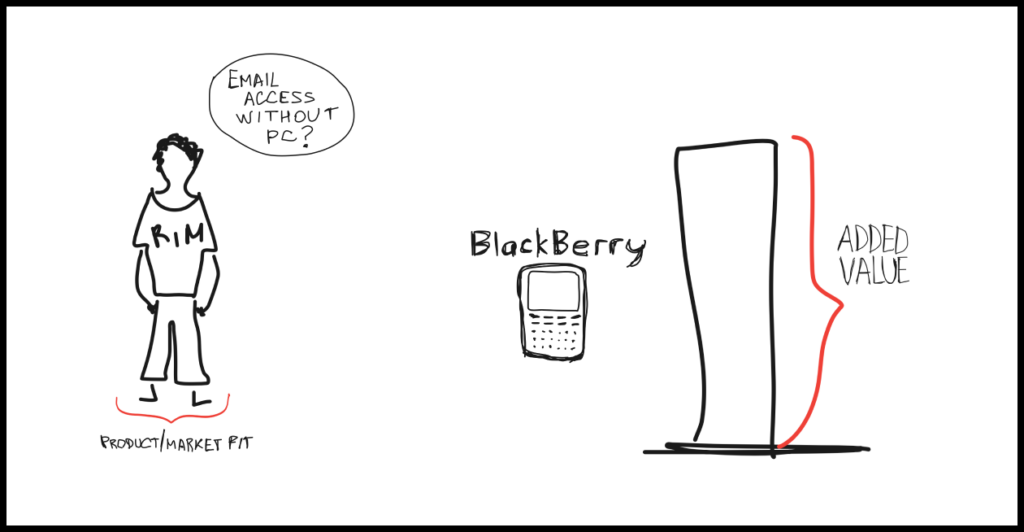

Achieving product/market fit

In mid-1990s, email rapidly gained popularity. The technology emerged from universities and began to spread in corporate environments. Microsoft Outlook and Lotus Notes became the main email applications on personal computers.

At the same time, Research in Motion (RIM), a communications hardware company, was working on a large order from telecommunications company BellSouth. RIM developed a pager that could not only receive messages, but also send them.

During the development of the device, RIM engineers realized that they could easily forward emails received on computers to the pager. They developed a makeshift program and installed it on the computers of all employees.

The implementation was far from ideal. For example, new emails were not received automatically and had to be downloaded manually. The email reply functionality was even worse. The response was first sent to the email client on the computer, and only from there it went to the recipient. The system was unreliable and constantly broke due to imperfect architecture.

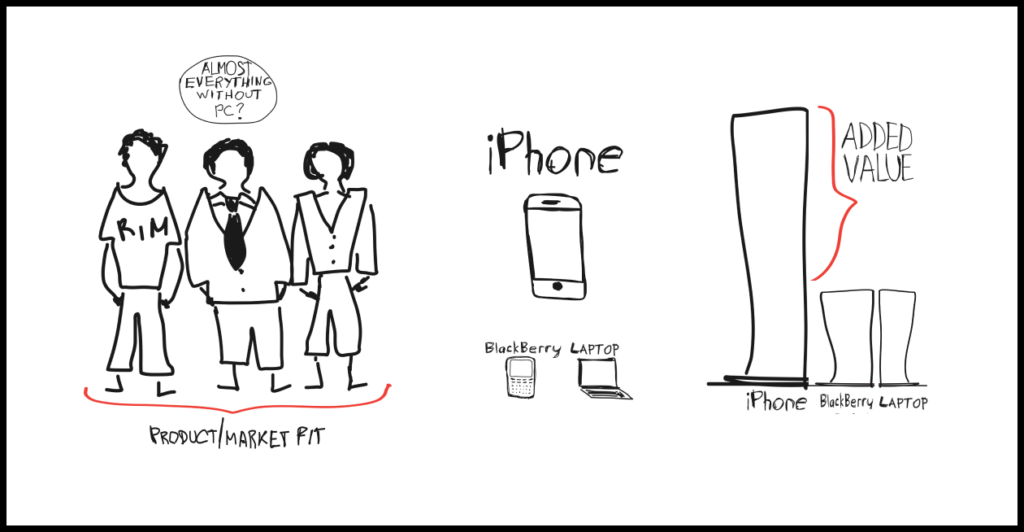

Despite this basic implementation, the new product quickly achieved product/market fit among RIM employees – they started using it to read and send emails. Many of them became addicted to the device, checking it constantly—in the car, at home, at meetings. For RIM, this was clear proof that they had found something of value.

RIM’s device made it possible to send and receive emails in situations where a personal computer was not available. In this context, the RIM product was the only available solution to the problem, so even the basic implementation of the email functionality was enough to achieve product/market fit.

The state of product/market fit at this stage of the company’s development was as follows:

- Task and context: Send and receive emails in situations where a personal computer is not available.

- Alternatives: None.

- Added value: Receive, read, and send emails from your mobile device. But the architecture of the solution was unreliable and the devices were assembled in a makeshift fashion and in small numbers.

- Product/market fit: There was enough added value to achieve product/market fit among RIM employees, but the device and technology were not ready for the consumer market.

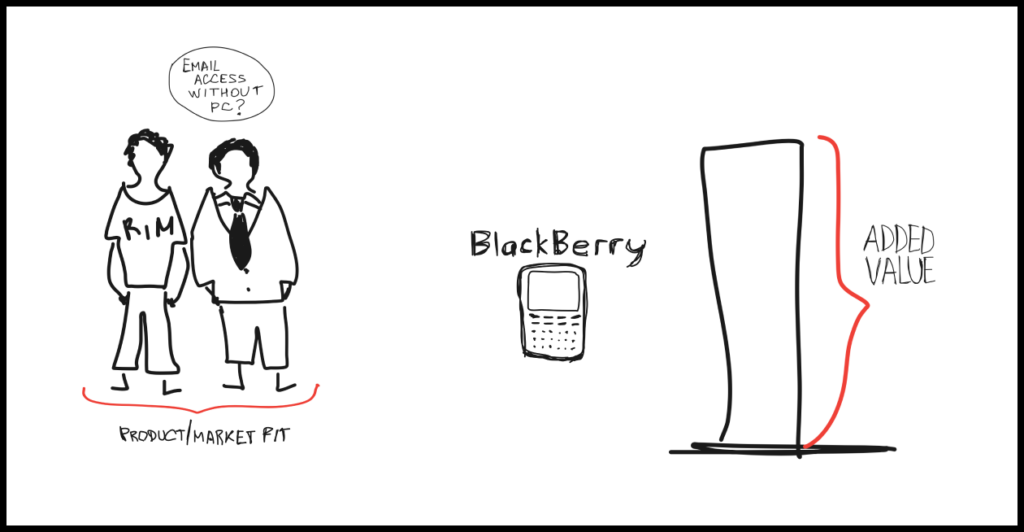

Strengthening product/market fit through product development and market research

The RIM team proved that the product can create enough value to achieve product/market fit. The team members began using the device for a significant portion of their email exchanges. Where personal computers weren’t accessible, the new device became their only and main way to send and receive email.

But the makeshift product was not ready for mass production and sale. This version of the product did not meet the expectations of most ordinary consumers and did not have product/market fit in the mass market.

The team focused on turning the prototype into a full-fledged product. This required refining the device itself (keyboard, screen, sound), implementing high-quality technology for sending and receiving emails, developing interfaces for working with emails on a small screen, and several other improvements.

Improving each of these aspects made the product more effective at its task, which increased its added value and the strength of its product/market fit.

But product improvement is not the only way to influence product/market fit strength. The same product creates different value for different users. After studying potential consumers, the RIM team identified a segment of entrepreneurs and managers whose work mostly relied on email.

In this segment, the added value of mobile email was so high that even the first basic version of the BlackBerry device caused a wow effect. The team achieved product/market fit in the new segment. And that’s where the rise of BlackBerry began.

The state of product/market fit at this stage of the company’s development was as follows:

- Task and context: Send and receive in situations where personal computers are not accessible.

- Alternatives: None.

- Added value: increased efficiency in work due to anytime email access. The new version of the device was significantly more efficient than the early prototype.

- Product/market fit: The first full version of BlackBerry achieved product/market fit in the segment of top managers of banks and law firms, and their subordinates. Managers wanted to get answers to their emails faster, so they bought BlackBerry devices for their subordinates.

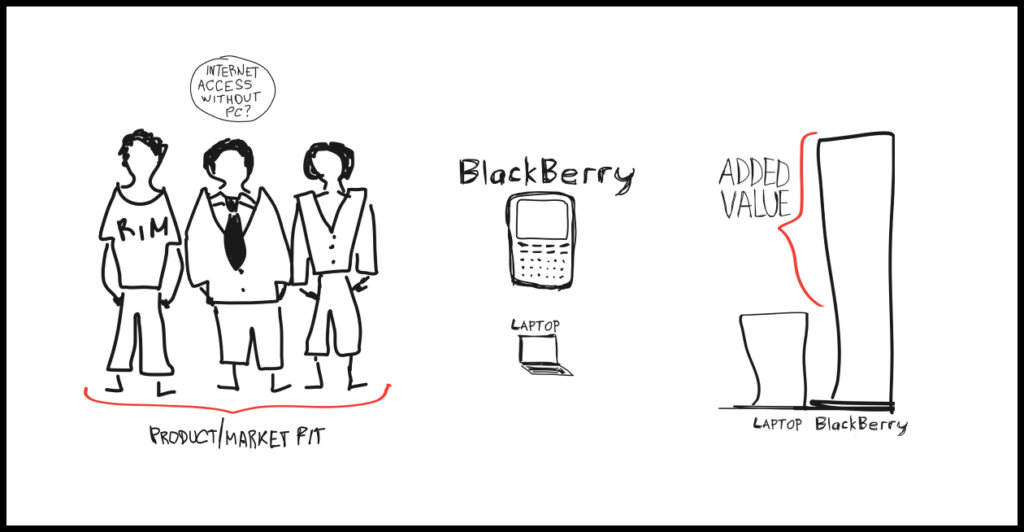

Increasing the strength of product/market fit by working on ways of delivering value

Against the background of rapid growth in the segment of corporate top managers, the RIM team decided to try to sell devices directly to companies. But there was a problem.

At large companies, bulk purchases are the responsibility of the chief information officer (CIO), whose tasks and interests are quite different from the interests and expectations of top managers.

For top executives, the BlackBerry device solved the problem of accessing email anywhere and anytime. CIOs of large companies did not have such a need, so BlackBerry did not find a product/market fit in this segment.

CIOs are a conservative bunch and do not like to take risks. They don’t like spending huge budgets to purchase untested devices for the entire company. To facilitate the sales of devices through CIOs, BlackBerry had to prove that the product would increase the efficiency of employees. Bulk sales also needed approvals at different levels.

One such sale could take a year or even more (standard transaction time when working with a large company). RIM wasn’t happy with the pace, so they came up with a different sales strategy that built on what was already working—selling to top executives through sales evangelists.

A special software was created that allowed any user to independently connect a BlackBerry to her corporate email. Prices of BlackBerry were adjusted to the equipment budgets of top managers of large companies. These top managers became the prime target for sales evangelists.

This strategy allowed RIM to quickly and efficiently get top executives of target corporations on BlackBerry. After reaching a critical mass of users in the management of a particular company, RIM went to the CIO with the support of top management and quickly got approval to install RIM servers at the company’s premises and purchase devices for all employees.

The product was distributed in the company, starting with the top management, who had enough power to implement changes. This go-to-market strategy gave RIM a significant share of the US corporate market.

Later, RIM finalized the product, received all the necessary certifications, built relationships with the CIO community and learned how to sell through them, removing the last barrier to dominance in the corporate market.

The state of product/market fit at this stage of development was as follows:

- Task and context: Send and receive emails in situations where there is no access to a personal computer.

- Alternatives: The first mobile devices with similar functionality from Symbian and Palm were gradually finding their way to the market. More and more popular were laptops that supported email and internet connectivity. Still, BlackBerry remained an unattainable standard in the corporate environment.

- Added value: Increased work efficiency due to anytime access to email. Gradual addition of phone, browser, messenger and other functions.

- Product/market fit: Product/market fit was extended to management positions in large US companies by consistently working on the product and creating a unique way to deliver the product’s value to the target market. The product also began to gradually conquer the consumer sector in the US and other countries.

iPhone and Android weaken BlackBerry’s product/market fit

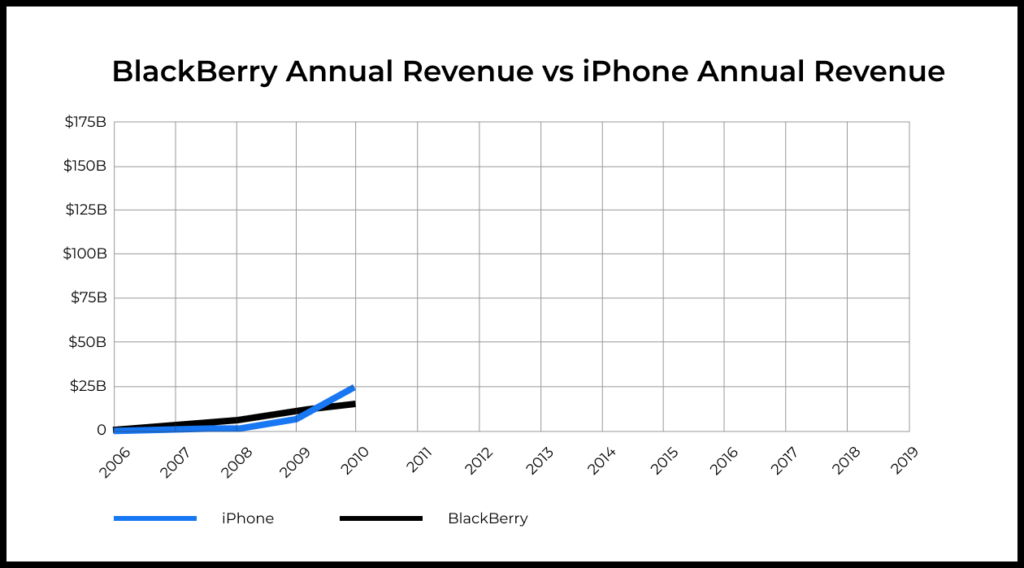

In 2007, Steve Jobs introduced the first iPhone. At the time, few immediately saw the potential of the new device. Today we are already fully aware of the impact it has had on our lives.

The iPhone and other smartphones hit Blackberry’s position in the consumer market. These new devices were more efficient in solving most tasks, including sending and receiving emails.

As app stores with active developer ecosystems evolved and emerged, BlackBerry fell behind. Consumers increasingly chose the iPhone as their go-to device for mobile email.

Despite a strong blow to the consumer segment, BlackBerry’s position remained strong in the corporate sector. BlackBerry devices were famous for their security and had a large loyal user base. The company also had long-term contracts and well-established relationships with large companies. High switching costs and product efficiency allowed BlackBerry to maintain a strong product/market fit in the corporate market.

But over time, the development of the iOS and Android platforms continued to increase the added value of their respective devices and eventually put them ahead of BlackBerry in the corporate sector.

With every new iOS and Android update, developers increasingly gravitated toward these platforms. Consequently the product/market fit of BlackBerry got weaker and weaker.

Over time, the email client became a common feature of modern smartphones. iOS and Android email apps were in no way inferior to BlackBerry and even surpassed it, since they seamlessly connected to many other useful work tools.

The state of product/market fit at this stage of the company’s development was as follows:

- Task and context: Send and receive emails in situations where there is no access to a personal computer.

- Alternatives: iPhone and Android smartphones.

- Added value: the iPhone gradually caught up with BlackBerry in email efficiency, and then was able to offer even greater added value by solving many other tasks.

- Product/market fit: The advent and development of modern smartphones weakened BlackBerry’s product/market fit, first in the consumer segment, and then in the corporate segment, where switching costs and efficiency were higher due to strong encryption, long-term contacts, and direct relationships.

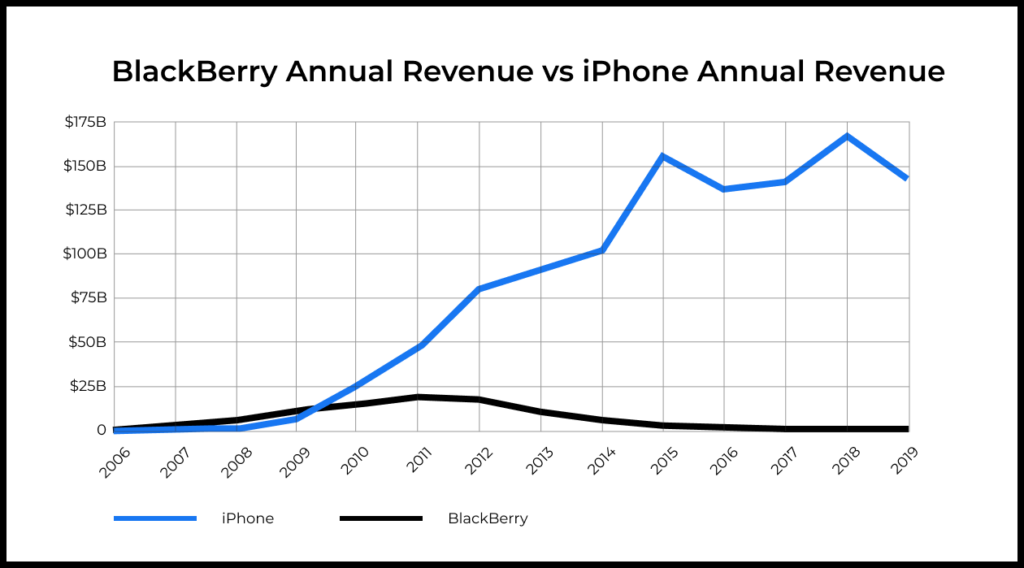

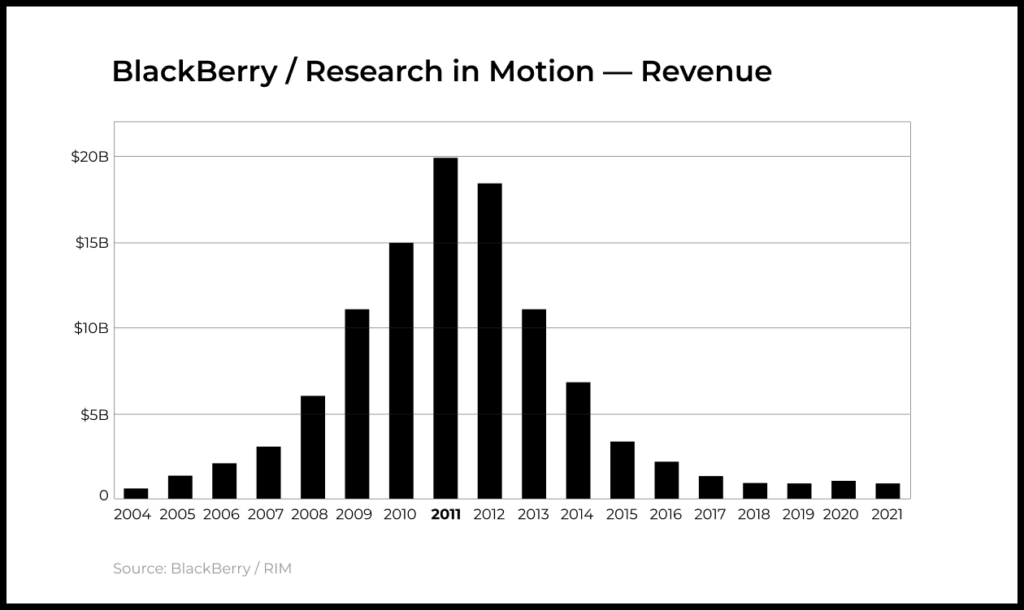

Dynamics of BlackBerry’s revenue and product/market fit strength

In 1999, BlackBerry created the most efficient way to send and receive emails on a mobile device. This allowed them to achieve product/market fit.

Consistent product development (increasing the efficiency of solving customers’ problems and strength of product/market fit), building sales channels, and geographic expansion became drivers of the company’s rapid growth.

But in 2007, the balance of power was disrupted. iPhone and Android devices arrived and soon overtook BlackBerry in efficiency. The added value of BlackBerry initially declined, and after a while became negative. As a result, the product/market fit first weakened and then completely disappeared.

BlackBerry sales peaked in 2011, four years after the launch of the iPhone. After that, the decreased added value and weakening of product/market fit led to a decline in BlackBerry’s sales. The downturn began in the US consumer market, continued in other countries, and eventually hit the corporate sector, BlackBerry’s strongest market.

From the essence of product work to product/market fit and added value

Let’s recall the key ideas of the past essays of the series:

- The essence of product work is to create more effective ways to solve user problems. This is the key growth driver for any product.

- To evaluate product work, you must measure problem-solving efficiency and added value. A product’s added value in comparison to alternative solutions determines its key product metrics (Retention, LTV, and others), which, in turn, determine growth metrics.

- The added value of a product is the fundamental driver of product/market fit and product growth. The potential gain from using a new product motivates users to switch solutions and leads to a redistribution of “work” in the market.

- The added value required to reach product/market fit varies across different tasks and market segments. In general, the product reaches product/market fit in a segment if its added value outweighs the costs of switching.

- Product/market fit is dynamic. Its strength can change over time and is influenced by both the state of the product itself and external factors such as competition or the market. For example, the pandemic redefined the effectiveness of existing products in many markets.

- Increasing the strength of product/market fit is one of the key levers of influence on product growth rates. The strength of product/market fit fuels retention, monetization, and acquisition.